Hi @lubos, thanks for your response.

ZIMRA’s new system in 2024 involves implementing individual QR codes for each sales invoice, credit note etc. In order for this to be standardised across all the different accounting packages that are being used in the country, they have stipulated we all need to comply with their ‘templates’, which dictate terminology used, layout etc.

Unfortunately, they haven’t given us these templates as a simple, unambiguous example, and instead have relied on intermediary fiscalisation companies (one of which is called Axis) to communicate the ZIMRA requirements. So I can’t give you their OFFICIAL document stating what they require.

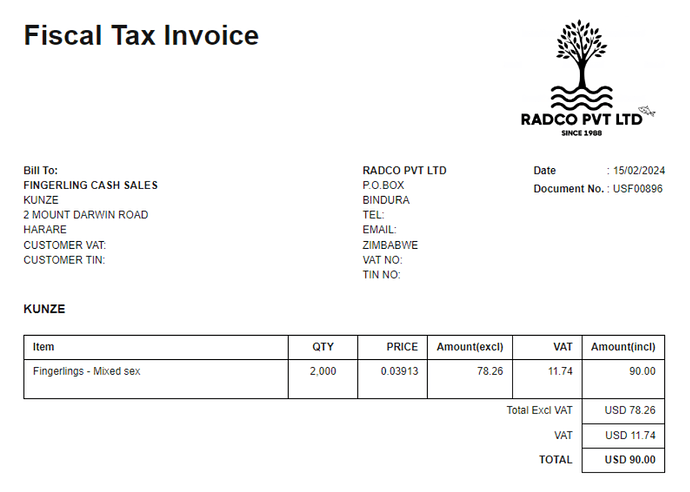

However, from multiple ‘back-and-forths’ with informed persons at Axis, we have narrowed it down to needing a template such as the sample that I’ve included immediately below:

I have 2 different sets of custom theme code that almost fulfil these requirements.

@Mabaega is referring to an issue we encountered and got stuck on (via forum private messages) in one of these series of code.

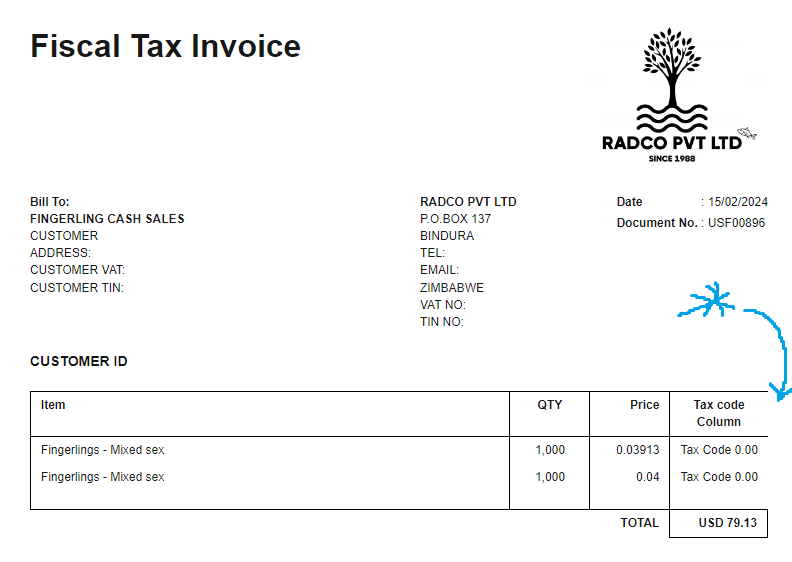

In this, somehow the Tax Code Column is initially hidden (which is great and fits ZIMRA requirements), but there is an issue whenever the Tax Code is set to 0% - demonstrated as follows:

- if the Tax Code % on any invoice/credit note using this custom theme has the Tax Code value set to 0%, the right side of the table disappears, as well as the amount column etc. The Tax Code column itself also reappears (please see screenshot below where I have used an arrow to highlight the issue):

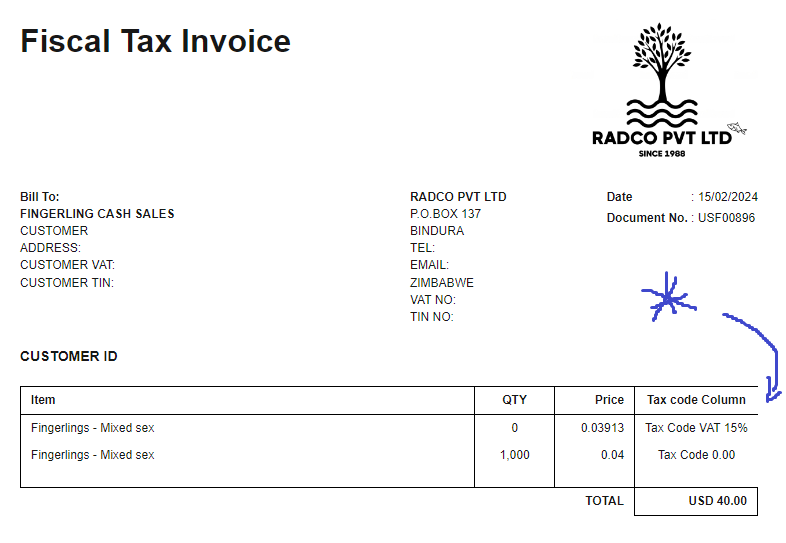

- It repeats this ‘glitch’ if the Quantity of items with 15% is set to zero on an invoice that has a 0% Tax Code on it (see screenshot):

- It does not appear to do this when including one item with a Tax Code value of a whole number greater than 0%, e.g 14.5% or 15% (please see screenshot below).

I have not changed anything on the edit screens besides the tax codes selected or the quantity as mentioned.

I have debugged it down to the issue being due to something in the ‘For loops’ in the code, but I cannot figure out how to solve it and @Mabaega has suggested that it is more complicated than that and needs your attention.

Given that there are quite a few products in Zimbabwe that are zero tax rated, it is necessary to make it work with 0% as well as with the more standard 15% tax etc.

I hope I have given you what you asked for - apologies if it was a bit long-winded.