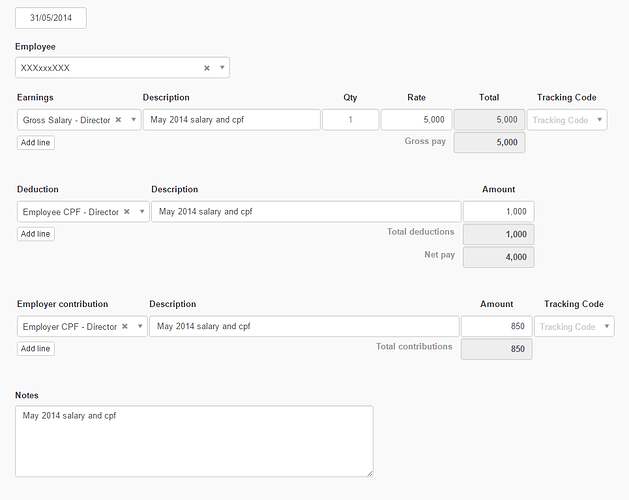

Before you can issue the first payslip, you need to setup payslip items. Payslip items are types of earnings, deductions and employer contributions. Once you create your payslip items, you will be able to use them on your payslips.

Earnings items

Earnings items are typically wages, salary, bonus, commission and various allowances. It’s types of earnings your employee will see on their payslip.

When you setup an earnings item, you will need to select an expense account. Usually, the appropriate expense account for any earnings item is the Wages and salaries account but you can link the earnings item to another expense account, if required.

Deduction items

Deduction items are typically payroll taxes but there are also other deductions such as insurance, union fees or wage garnishment.

To add a new deduction item to be used on a payslip:

- Go to

Settingstab. - Click

Payslip Items. - Click

New Deduction Itembutton. - Enter the description of the deduction item.

- Click

Createbutton to save the deduction item.

When you setup deduction items, you also need to select a liability account. This is because deductions from an employee’s gross pay (e.g. payroll tax, union fees) are payable to someone else (e.g. tax authority, union).

You can allocate all deduction items to the general Payroll liabilities account but it’s preferable to setup custom liability accounts under the Chart of Accounts for each deduction item to track the liability for each item separately on the balance sheet.

Employer Contribution Items

Employee contribution items are special items that are characterized as both earnings and deductions..

For example, if you are required to contribute a certain percentage of an employee’s gross pay into a pension or superannuation fund, it is regarded as a contribution. It represents employee earnings but is deducted from their gross pay at the same time and is subsequently paid to their pension fund.

Another example is if you have a type of matching program where you add to an employee’s charity contribution. Through a matching gift program, your policy may be to double or even triple an employee’s contribution toward a charity.

When you setup an employer contribution item, you need to select an expense account (e.g. Superannuation or Charity contribution). And at the same time you also need to select a liability account (e.g. Superannuation payable or Charity contribution payable).