but its needed to maintain the book accurately.

It is accurate. My invoice total and their total matches. Manager’s bank balance and my bank accounts tally and I have a record of the rounding in a COA. So everything is balanced and is recorded.

that is a option users need to create. but rounding off button should be provided as default in sales invoice as well as purchase invoice

The rounding option has long been present for sales invoices. You can make it default in the Settings tab under Form Defaults.

i was just mentioning a point for him. this thread is about getting a rounding off check mark in purchase invoice too… i m in favor for it to be implemented.

@lubos is there any chance of implementing rounding off in purchase invoice or any similar situation. like the option available in sales invoice.

I have just encountered the issue of my purchase invoice not matching an invoice from a supplier due to differences in rounding. It looks to me like Manager rounds off line totals before adding them, whereas my supplier’s accounting system seems to have added the line items and then rounded off. Here’s an example:

| Amount | 15% VAT on amount | VAT rounded | |

|---|---|---|---|

| 682.43 | 102.3645 | 102.36 | |

| 2274.75 | 341.2125 | 341.21 | |

| Total | 2957.18 | 443.577 | 443.57 (sum of above) |

My supplier’s invoice gives a total VAT of $443.58, but Manager gives $443.57.

In this invoice there are other line items with different tax rates applied. I suspect that if all lines had the same tax applied, Manager would calculate the tax based on the total.

You need to adjust the purchase invoice in Manager so that it agrees with your supplier. You can do this manually or play around with the tax inclusive and tax exclusive option so get the right option.

Most modern accounting system work like Manager ie calculate tax line by line and then total.

I don’t think the VAT authority will be after you for 1 cent

Thanks. I agree that they probably won’t come after me for 1 cent, but it’s always nice to have everything perfectly balanced. I achieved what I needed by making my purchase invoice tax inclusive, as you suggest, which I discovered I had actually figured out previously on another invoice.

Anyway, my main reason for posting the above example was to present a real-life scenario in which the requested feature would be useful, I think, and to illustrate a potential source of the issue for some users.

In Australia rounding has to be done on the total.

However it is also acceptable for:

- Accounting software to define the precision is uses on the line items and round line items to program precision

- For different compliant rounding to be used by supplier and customer

As a result in Australia Managers method is acceptable and the amounts do not need to equal the suppliers invoice. Entering prices as tax inclusive ensures bank reconciliation also balances.

@lubos I also feel this is required.

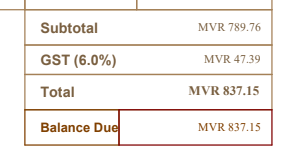

Eg: my supplier’s purchase invoice total is:

while Manager’s purchase invoice is:

I think when done in Excel, it shows the same as supplier’s purchase invoice.

Unless, we manually do a calculation for tax included line items, is there a way to make the total same as supplier’s purchase invoice total?

I feel for a purchase invoice with lot of items, to create a manual tax included line item list to enter to Manager will take a lot of time. An easy solution is needed.

Thanks

is the button being added in purchace invoice or not?

@lubos Please update us on this feature. I, too think we need a rounding off option in Purchase Invoice just like the sales.