Temporary Solution I Have Tried for Displaying QR Code Phase II

Temporary Solution I Have Tried for Displaying QR Code Phase II

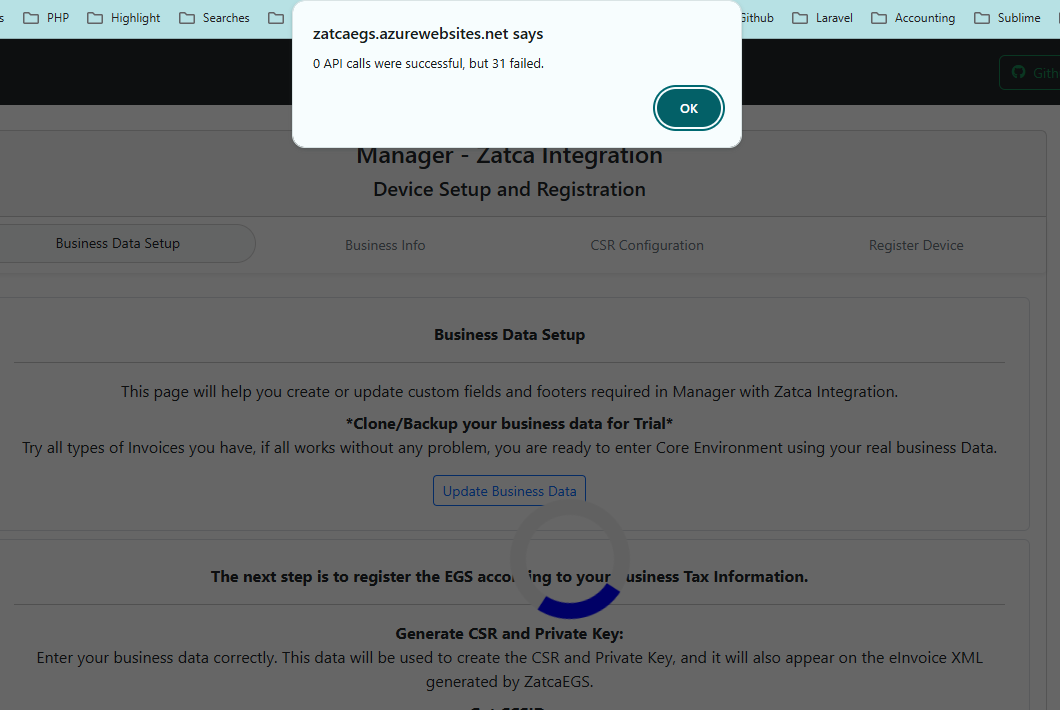

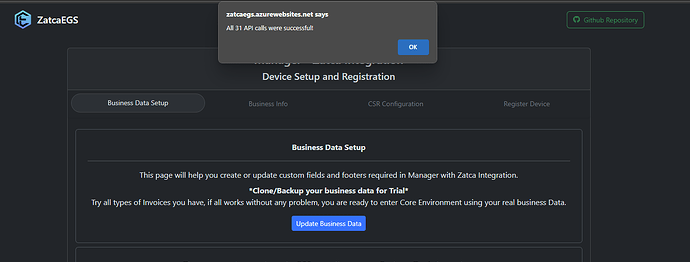

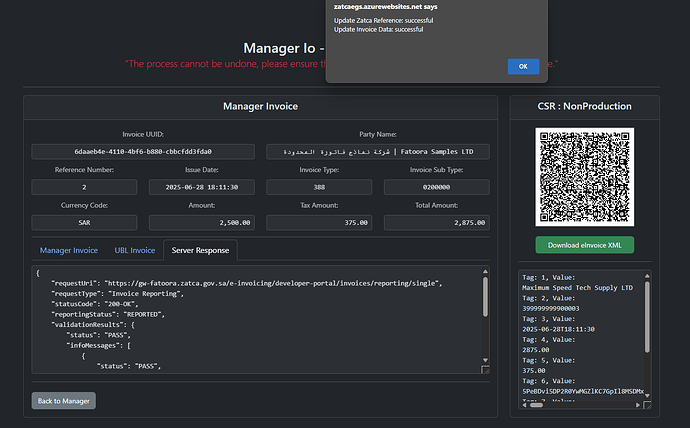

This is a temporary solution that I have personally tested and confirmed to work:

Make sure to back up your Business Data before trying it.

- Set a Custom Field (Base64 QR Code) to Appear on Printed Document

Configure a custom field to contain the Base64 QR code, and ensure it is visible on the printed version of the invoice.

- Create a Custom Theme to Display QR Code Phase II

Develop a custom invoice theme specifically designed to show the QR code from the custom field.

→ Make sure to record the GUID of the custom theme you’ve created.

<!DOCTYPE html>

<html>

<head>

<meta charset="UTF-8" />

<meta name="viewport" content="width=device-width, initial-scale=1.0" />

<!-- Styling for consistent look and feel -->

<style>

*, ::after, ::before, ::backdrop, ::file-selector-button {

margin: 0;

padding: 0;

}

*, ::after, ::before, ::backdrop, ::file-selector-button {

box-sizing: border-box;

border: 0 solid;

}

body {

margin: 0;

padding: 30px;

font-family: 'Helvetica Neue', Helvetica, Arial, sans-serif;

color: #171717;

font-size: 12px;

line-height: 1.428571429;

}

table {

font-size: 12px;

}

tr#table-headers th {

font-weight: bold;

padding: 5px 10px;

border: 1px solid #000;

text-align: start

}

tbody#table-rows td {

padding: 5px 10px;

border-left: 1px solid #000;

border-right: 1px solid #000;

text-align: start;

vertical-align: top

}

tbody#table-rows tr:last-child td {

padding-bottom: 30px;

border-bottom: 1px solid #000;

}

</style>

</head>

<body>

<!-- Top section: document title and optional business logo -->

<table style="margin-bottom: 20px; width: 100%">

<tbody>

<tr>

<td style="vertical-align: top">

<div style="font-size: 32px; line-height: 32px; font-weight: bold" id="title">Invoice</div>

</td>

<td style="text-align: end" id="business-logo">

</td>

</tr>

</tbody>

</table>

<!-- Second section: recipient info, document fields (like date, invoice #), and business info -->

<table style="margin-bottom: 20px; width: 100%">

<tbody>

<tr>

<td style="vertical-align: top" id="recipient-info"></td>

<td style="text-align: end; vertical-align: top" id="fields"></td>

<td style="width: 20px"></td>

<td style="width: 1px; border-left-width: 1px; border-left-color: #000; border-left-style: solid"></td>

<td style="width: 20px"></td>

<td style="width: 1px; white-space: nowrap; vertical-align: top" id="business-info"></td>

</tr>

</tbody>

</table>

<!-- Description block -->

<div style="font-weight: bold; font-size: 14px; margin-bottom: 20px" id="description"></div>

<!-- Main table containing column headers, line items, and totals -->

<table style="border-collapse: collapse; width: 100%">

<thead>

<tr id="table-headers"></tr>

</thead>

<tbody id="table-rows">

</tbody>

<tbody id="totals">

</tbody>

</table>

<script src="resources/qrcode/qrcode.js"></script>

<div id="qrcode" style="margin-bottom: 20px"></div>

<!-- Section for any additional custom fields -->

<div id="custom-fields"></div>

<!-- Section for footers -->

<table><tr><td><div id="footers"></div></td></tr></table>

<!-- Section for final status (e.g. PAID, VOID) with special styling -->

<div id="status" style="text-align: center"></div>

<script>

// Listen for messages sent from the parent frame (via postMessage API)

window.addEventListener("message", (event) => {

if (event.source !== window.parent) return; // Only accept messages from parent

if (event.data.type !== 'context-response') return; // Ignore irrelevant messages

// Extract the main data object sent from parent

const data = event.data.body;

// Set text direction (LTR or RTL) for the whole document

document.documentElement.dir = data.direction;

// Populate title and description if provided

document.getElementById("title").innerHTML = data.title || "No title";

document.getElementById("description").innerHTML = data.description || "";

// Inject business logo image if available

var businessLogoTd = document.getElementById("business-logo");

if (data.business.logo) {

const img = document.createElement("img");

img.src = data.business.logo;

img.style = "max-height: 150px; max-width: 300px; display: inline";

businessLogoTd.appendChild(img);

}

// Populate business info section with name and address (convert line breaks)

const business = data.business || {};

document.getElementById("business-info").innerHTML = `<strong>${business.name || ""}</strong><br>${business.address ? business.address.replace(/\n/g, "<br>") : ""}`;

// Populate recipient info section with name and address (convert line breaks)

const recipient = data.recipient || {};

document.getElementById("recipient-info").innerHTML = `<strong>${recipient.name || ""}</strong><br>${recipient.address ? recipient.address.replace(/\n/g, "<br>") : ""}`;

// Insert fields (e.g. issue date, due date) into right-hand side

const fieldsDiv = document.getElementById("fields");

fieldsDiv.innerHTML = "";

(data.fields || []).forEach(f => {

const div = document.createElement("div");

div.innerHTML = `<strong>${f.label}</strong><br />${f.text || ""}<br /><br />`;

fieldsDiv.appendChild(div);

});

// Build table headers dynamically based on `columns` definition

const headersRow = document.getElementById("table-headers");

headersRow.innerHTML = "";

(data.table.columns || []).forEach(col => {

const th = document.createElement("th");

th.innerHTML = col.label;

th.style.textAlign = col.align;

if (col.minWidth) {

th.style.whiteSpace = 'nowrap';

th.style.width = '1px';

}

else if (col.nowrap) {

th.style.whiteSpace = 'nowrap';

th.style.width = '80px';

}

headersRow.appendChild(th);

});

// Populate main table body with rows and alignments based on column definitions

const rowsBody = document.getElementById("table-rows");

rowsBody.innerHTML = "";

(data.table.rows || []).forEach(row => {

const tr = document.createElement("tr");

row.cells.forEach((cell, i) => {

var col = data.table.columns[i];

const td = document.createElement("td");

td.innerHTML = (cell.text || "").split("\n").join("<br />");

td.style.textAlign = col.align;

if (col.minWidth) {

td.style.whiteSpace = 'nowrap';

td.style.width = '1px';

}

else if (col.nowrap) {

td.style.whiteSpace = 'nowrap';

td.style.width = '80px';

}

tr.appendChild(td);

});

rowsBody.appendChild(tr);

});

// Populate totals section with subtotals, taxes, grand total, etc.

const totalsBody = document.getElementById("totals");

totalsBody.innerHTML = "";

(data.table.totals || []).forEach(total => {

const tr = document.createElement("tr");

const tdLabel = document.createElement("td");

const tdValue = document.createElement("td");

tdLabel.innerHTML = total.label;

tdLabel.colSpan = data.table.columns.length - 1;

tdLabel.style = 'padding: 5px 10px; text-align: end; vertical-align: top';

tdValue.innerHTML = total.text;

tdValue.id = total.key;

if (total.class) tdValue.classList.add(total.class);

tdValue.dataset.value = total.number;

tdValue.style = 'padding: 5px 10px; border: 1px solid #000; text-align: right; white-space: nowrap; vertical-align: top';

// Bold totals if marked as 'emphasis'

if (total.emphasis) {

tdLabel.style.fontWeight = 'bold';

tdValue.style.fontWeight = 'bold';

}

tr.appendChild(tdLabel);

tr.appendChild(tdValue);

totalsBody.appendChild(tr);

});

// Render custom fields section below the table (e.g. notes, terms)

const customFieldsDiv = document.getElementById('custom-fields');

customFieldsDiv.innerHTML = '';

let qrcodetext = '';

(data.custom_fields || []).forEach(f => {

if (f.label === 'Base64 QRCode') {

qrcodetext = f.text;

} else {

const div = document.createElement('div');

div.innerHTML = `<strong>${f.label}</strong><br />${(f.text || '').split('\n').join('<br />')}<br /><br />`;

if (f.displayAtTheTop === true) {

fieldsDiv.appendChild(div);

} else {

customFieldsDiv.appendChild(div);

}

}

});

// Render footers section

const footersDiv = document.getElementById("footers");

footersDiv.innerHTML = "";

(data.footers || []).forEach(f => {

const div = document.createElement("div");

div.style = 'margin-top: 20px';

div.innerHTML = f;

footersDiv.appendChild(div);

// Find and execute any script tags

const scripts = div.querySelectorAll("script");

scripts.forEach(script => {

const newScript = document.createElement("script");

// Copy script attributes if needed

for (const attr of script.attributes) {

newScript.setAttribute(attr.name, attr.value);

}

// Inline script handling

if (script.textContent) {

newScript.textContent = script.textContent;

}

// Replace the old <script> with the new one so it executes

script.parentNode.replaceChild(newScript, script);

});

});

// Display status label (e.g. PAID, CANCELLED) with colored border based on status type

const statusDiv = document.getElementById("status");

if (data.emphasis?.text != null) {

statusDiv.style.marginTop = '40px';

const span = document.createElement("span");

span.style = 'border-width: 5px; border-color: #FF0000; border-style: solid; padding: 10px; font-size: 20px; text-transform: uppercase';

if (data.emphasis.positive) {

span.style.color = 'green';

span.style.borderColor = 'green';

}

if (data.emphasis.negative) {

span.style.color = 'red';

span.style.borderColor = 'red';

}

span.innerHTML = data.emphasis.text;

statusDiv.appendChild(span);

}

const qrcodeDiv = document.getElementById('qrcode');

// This handles QR code Phase II on invoices for Saudi Arabia

if (qrcodetext && qrcodetext.length > 10 && qrcodeDiv) {

qrcodeDiv.innerHTML = '';

renderQRCode(qrcodetext, 'qrcode');

} else {

// This handles QR code on invoices for Saudi Arabia - this is here just temporarily. Better way will be implemented.

if (data.type === 'salesinvoice') {

if (data.business.country === 'ar-SA' || data.business.country === 'en-SA') {

function appendTLV(tag, text, byteList) {

const encoded = new TextEncoder().encode(text);

byteList.push(tag);

byteList.push(encoded.length);

for (let b of encoded) byteList.push(b);

}

const byteList = [];

let businessName = 'No name';

if (data.business) businessName = data.business.name;

let vatNumber = '0000000000000';

let vatField = data.business.custom_fields.find(item => item.key === 'd96d97e8-c857-42c6-8360-443c06a13de9');

if (vatField) vatNumber = vatField.text;

let timestamp = new Date((data.timestamp - 621355968000000000) / 10000).toISOString();

let total = 0;

let totalElement = document.getElementById('Total');

if (totalElement != null) total = parseFloat(totalElement.getAttribute('data-value'));

let vat = 0;

let taxAmounts = document.getElementsByClassName('taxAmount');

for (let i = 0; i < taxAmounts.length; i++) {

vat += parseFloat(taxAmounts[i].getAttribute('data-value'));

}

appendTLV(1, businessName, byteList);

appendTLV(2, vatNumber, byteList);

appendTLV(3, timestamp, byteList);

appendTLV(4, total.toFixed(2), byteList);

appendTLV(5, vat.toFixed(2), byteList);

// Convert to Uint8Array

const tlvBytes = Uint8Array.from(byteList);

// Convert to Base64

const qrData = btoa(String.fromCharCode(...tlvBytes));

console.log(qrData);

new QRCode(document.getElementById('qrcode'), {

text: qrData,

width: 128,

height: 128,

colorDark: '#000000',

colorLight: '#ffffff',

correctLevel: QRCode.CorrectLevel.L

});

}

}

}

function renderQRCode(content, elementId) {

new QRCode(document.getElementById(elementId), {

text: content,

width: 160,

height: 160,

colorDark: '#000000',

colorLight: '#fafafa',

correctLevel: QRCode.CorrectLevel.L

});

// Tambahan opsional: parsing isi QR untuk tooltip

let details = parseQRCodeContent(content);

if (details.size > 0) {

let title = Array.from(details)

.map(([tag, value]) => `Tag ${tag} : ${value.join(', ')}`)

.join('\n');

const qrCodeDiv = document.getElementById(elementId);

if (qrCodeDiv) qrCodeDiv.title = title.trim();

}

}

function parseQRCodeContent(qrCodeBase64) {

let details = new Map();

try {

let data = atob(qrCodeBase64.replace(/\+/g, '+'));

let index = 0;

while (index < data.length) {

let tag = data.charCodeAt(index++);

let length = data.charCodeAt(index++);

let value = data.substr(index, length);

index += length;

let decodedValue = (tag === 8 || tag === 9)

? [...value].map(c => c.charCodeAt(0).toString(16).padStart(2, '0')).join(' ').toUpperCase()

: new TextDecoder('utf-8').decode(new Uint8Array([...value].map(c => c.charCodeAt(0))));

details.set(tag, [decodedValue]);

}

} catch (ex) {

console.error('Error decoding QR code: ' + ex.message);

}

return details;

}

}, false);

// Request context data from parent frame when page loads

window.addEventListener("load", () =>

window.parent.postMessage({ type: "context-request" }, "*")

);

</script>

</body>

</html>

- Batch Update All Reported Invoices

Perform a batch update for all invoices that have already been REPORTED or CLEARED:

- Remove the old footer containing the QR Code Phase II.

- Apply the new custom theme (using the saved GUID) to those invoices.

- Remove QR Code Phase II Footers

Go to Settings → Footers and delete the QrCodePhaseII footer from both Sales Invoices and Credit Notes, since it is no longer used.

- Continue Using the Custom Theme for New Invoices

Going forward, use the custom theme for all future invoices to ensure the QR code displays correctly.