How to make a transaction to refill Petty Cash with a cash over and short in credit.

When I make this as spend money, the credit is only the cash account.

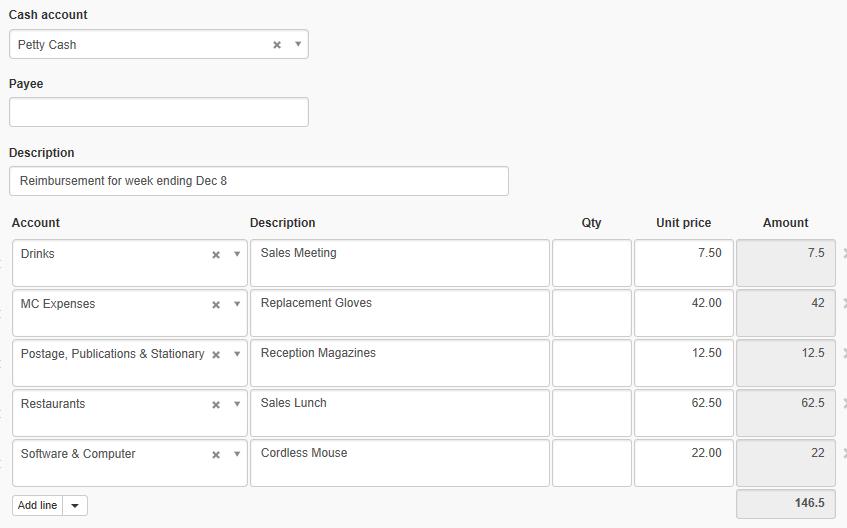

For example:

(Debit)

Postage Expense

Misc. Expense

(Credit)

Cash

Cash Over and Short

You have not made clear how you are entering transactions. But if you are using journal entries, that is not correct. In Manager, all transactions involving actual movement of money should be entered in Bank Transactions, Cash Transactions, or Inter Account Transfers. To refill a petty cash fund or till, use an inter account transfer.

You enter the “cash over and short” amount with a minus sign in front (-5.64)

They wrote “When I make this as spend money”

This wont apply if you are operating an impress account as per the example.

Yes, I read that. But @Akbar_Rizky went on to list debits and credits, leading to a potential conclusion that journal entries were being used. So I addressed that possibility. I then went on to address the proper method to “refill Petty cash.” If a petty cash fund is being refilled, you are transferring money into it, and the right way to do that is by inter account transfer.

The example did not specify that the petty cash fund is an imprest account. But whether it is or not, the way to refill or replenish it is with an inter account transfer. If it is an imprest account, only transfers into it are allowed, equal to documentable amounts spent from it, bringing it back to the authorized level.

No, if its an impress account then the right way is a Spend Money, not an inter account transfer, as the “documentable amounts spent” are not individually or separately posted.

I understand your point, which is valid in some workflows. I guess the question is how expenditures from the imprest fund are being documented. One approach, which you seem to be referring to, is to regard money going into the imprest fund as the expenditure, with documentation of what imprest funds are actually spent on not making it back to the main accounting system, but rather being recorded “offline” through receipts, chits, etc. Then spend money would be right.

Another approach is to consider the imprest fund as a pre-authorized source for small purchases within the authority and discretion of the imprest cashier, but periodically bring the expenditures back to the main accounts so they end up in the right category. Then inter account transfer would be right for refilling, and spend money for recording the small purchases.

One can find many different descriptions of exactly how imprest funds are administered. Some have limited purposes, such as only being used for office supplies, or travel advances, etc. In those cases, a spend money transaction to refill the imprest fund can be properly allocated to whatever expense account is appropriate. In the case where individual purchases are not brought back to the main accounts, I’ve seen imprest expenditures just lumped into miscellaneous expenses.