Where I do business, the tax rates can change every six months. It would be beneficial to specify a valid date on the taxes so we can specify when that tax rate was for.

I’d just enter this information into Name field.

There is Label field which is how the tax code should appear on printed documents.

Here is the problem I am running into -

For 2021 the sales tax rate was 7.5% for one location. All of my sales invoices were entered with prices that included the Tax in the amount.

For 2022 the sales tax rate is 8.0% for that location.

If I adjust that locations sales tax rate - it changes all of my sales data for that location in 2021 as well.

If I create a new tax rate, and have the date in the name of it, that shows up on my sales invoices which doesn’t look good to my customers. Also, if I am in business for the next 20 years, and continue to use manager, I am going to have an awfully lot of tax codes in the system that are no longer applicable, but are needed for historic reasons.

My current process is to create the new tax code with the same customer friendly name as the old tax code, add an end date to the name of the old tax code, and inactivate it. Because manager uses its own unique identifier, it doesn’t care if the names of the tax rates are all the same. Because users can’t see the unique identifier (Unless you copy and paste data into spreadsheets) You need to have unique names on your tax codes to be sure you are picking the correct one in your forms. The “Label” field only appears on invoices - and for my invoices it only appears if the invoices has more than one tax code applied.

Is adding a new tax code every time the rate changes the best way to automatically account for taxes in Manager without losing historical accuracy? I would really like to avoid having to manually calculate and enter tax on each invoice.

Thanks!

You could make the same argument about any data. When tax code is marked as inactive, it will be out view for new transactions so it’s not like you will stumble over it unless you are viewing historical transactions.

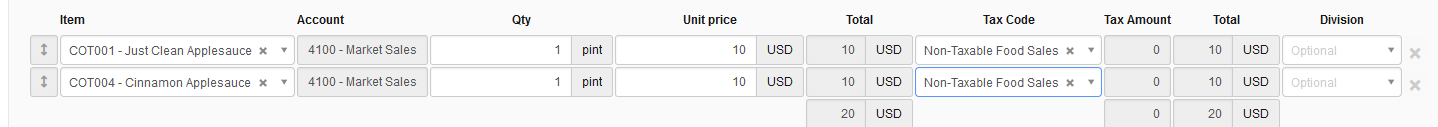

What happens when only one tax code is applied? Could you demonstrate with screenshot? This could be a bug.

Yes. This is the correct way.

Tax codes that you don’t need anymore for future transactions should be marked as Inactive so they are out of view as much as possible.