I use the software for my Self Directed IRA (individual retirement account) Checkbook LLC. Instead of stocks, etc. I purchase fractional real estate, fund microloans, etc. etc. I thought about setting up an A/R to track the asset as part of the value of my ira but not sure if that is right, or how I would do that since money has to leave the account. I also thought about inventory method, but I don’t have a final sales price since rate of return varies. Right now, i have it setup as a simple cash in / cash out and only record if and when the investment pays off.

Since Manager does not have a dedicated method for handling investments, not every user agrees on how to best handle it, but this topic may provide you some ideas;

Personally, I have found it much better to manage the details of such accounts outside of Manager using spreadsheets, and brokerage/custodian statements, and only entering aggregated transactions monthly.

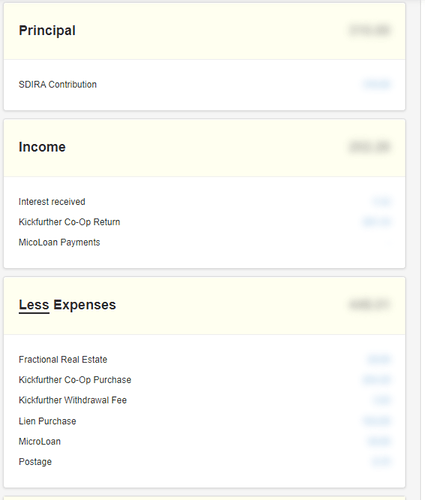

In general, your initial thinking was on the right track; investments should be setup as an asset account (though not an account receivable). It appears your principal investment is setup as an Income group. Any purchases of assets should be handled as Payments from your applicable cash account to the asset account. Right now it appears you have your purchase of investments setup as expenses.

Only Interest, Dividends, and Capital Gains (Loss) would be needed as Income accounts, and only expenses charged by your custodian (Checkbook LLC) unrelated to buying assets, such as management and transaction fees, etc. would be Expense accounts.

For any subsequent market value changes for a personal investment, in the U.S., you would record them via Journal Entries as an increase to the asset and a direct increase to equity (I am assuming you are based in the U.S. since you are referring to an “IRA”).

I hope this helps provide a starting point for you.