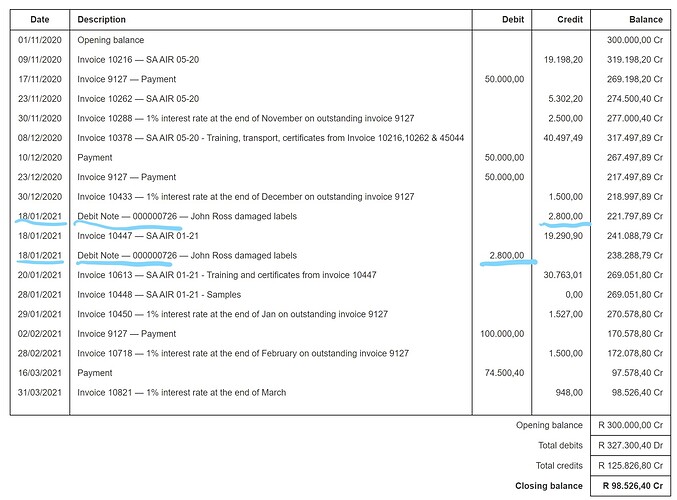

Something strange is happening with a debit note. As you can see below, the same amount appears twice, in both the credit and the debit columns. Any explanation?

Yup - I suspect you put the debit memo line right back to accounts payable for the supplier, so that it is basically debiting and crediting the supplier account. Did you mean to do that?

And if you post the edit screen for the Debit Note we will be able to confirm that

What is the debit memo line?

No

I do not understand why Manager requires to indicate the supplier and the invoice twice,

It doesn’t and in fact this is an error.

You should post the line entry to the account that the original purchase invoice was posted to as you are now reducing your purchases by the amount on the debit note

The intent is not to “reduce purchases” as in this case the Debit Note is a contribution from the supplier for something that is not related to purchases. You could call it a marketing contribution for example.

I am not sure I understand this. We purchase goods from this supplier, and I cannot post this Debit Note to our stock. Unless I create an account under Income where I can credit this amount to as it reduces our debt to the client, which otherwise means that it increases our income.

Or do you have other suggestions?

This debit note, as you clearly understand, either reduces your expenses or increases your income in addition to reducing the amount you owe your supplier.

Whether you treat it as an income or reduction in expense is up to you and your accountant but you must post the amount to one or the other. If you do not have an appropriate account you will have to create one.

The issue is that I do not understand how Manager adds a credit and a debit in the supplier statement when I just add a simple debit note and post it to account payables. It should just reduce the payable amount to that supplier, instead of reducing it and increasing it at the same time.

You are looking at the fundamental nature of double-entry accounting. The debit note debits Accounts payable for the selected supplier, reducing your liability towards them. It simultaneously credits the posting account you choose. In your case, you chose Accounts payable. This is why you must choose some other account. You can credit an income account, which will increase your income, or you can credit an expense account, which will decrease your expenses. Either one will increase net profit.

The supplier statement is reporting activity in Accounts payable. Since you chose the incorrect posting account, you are seeing the same amount debited and credited.

We used Debit Notes in the past, and I thought the current issue was due to an update in Manager. However, the previous Debit Notes were mainly due to damaged items, therefore the amount would go straight into the inventory account. In this new case I think the only way out is to use an ad-hoc income account.

Thanks for the help.

Be careful, because once you have used an account, you will be stuck with it forever.

If you have a Miscellaneous Income you could always use that

Forget about using a debit note. If the supplier is paying you as a contribution to marketing, this is income, pure and simple. Enter a receipt, posted to an appropriate income account. In this case, the supplier has become a customer.

@mauroskov if the contribution is in the form of funds that are deposited to your bank account, then you could create a receipt in Manager as @Tut has suggested.

If the contribution is in the form of a credit on your account with the supplier for future purchases then creating a debit note in Manager is the correct way to go with the amount going to an income account.

@AJD is correct. Note that I wrote, “If the supplier is paying you….” [Emphasis added.] That is how I interpreted your use of the word contribution. If they are only crediting your account, that means they gave you a credit note (or some form of equivalent) that you are entering as a debit note. As he said, though, it still has to be posted to an income account.