Yes Revaluation reserves account is usually under equity.

But can you make it automatic like when actual sale of the investment takes place then that account is credited/devited with the same amount and realized gains/losses goes to the PnL statement.

This way there would be no need for separate revaluation tabs.

@shahabb I’ve tried going that way but it doesn’t appear there is a consensus how the realized gains / losses ought to be calculated. FIFO, weighted average, LIFO, something else…

For this reason, depreciation entries and amortization entries are also separate transactions (depreciation and amortization is not calculated automatically)

Recording realized gains (losses) should work the same way. You get a report that will calculate realized figures for you (based on your chosen calculation method) and then you can copy the figures to a manual entry.

@lubos that would bring you back to where you started. According to my understanding the current issue some users are having is with the market valuation. As soon as we enter market valuation our gain or loss goes to the P&L.

Slight modification here needed is that instead of Investment market prices(in settings) it should be investment revaluations and a revaluation worksheet which would caluate the investment on cost basis with multiple methods like you mentioned for Inventory.

So this way if someone is only interested in realized gains(maybe for tax purposes) they would only value their investments at cost. Once sold the extra amount can go to the P&L and if someone wants to have unrealized gain on PnL they can enter market prices on the revaluation. Both issues are getting solved this way.

When purchasing securities there needs to be a parcel identifier linked to the cost per security so that when selling the securities this parcel identifier can be selected (multiple lines if more than one parcel involved) which will then calculate the realized gain for that transaction and report to the P&L Statement (sale total minus identified cost).

Correct.

The parcel identifier is the investment purchase entry.

When selling the investment the purchase entries actually being sold need to be identified. This process is identical to when receiving funds for a sales invoice except the purchase transaction acts as the invoice / parcel identifier.

The same as invoices Manager can select a default parcels for sale and the user can manually over ride it if required.

Doing so would enable support to any user select sale order and compliance with the ATO requirements https://www.ato.gov.au/individuals-and-families/investments-and-assets/capital-gains-tax/shares-and-similar-investments/keeping-records-of-shares-and-units

Whether Manger supports this process or not will not change the fact that this is what a user is required to do.

This discussion is not heading the direction that is useful. I’ve considered these ideas before.

Let’s find the common ground first.

If we go by the principle that balance sheet is ought to show foreign currency account balances at the market exchange rate. Do we agree that balance sheet should show investments at the market price (or fair value) rather than the original cost?

No.

-

Accounting software built in support for asset / investment revaluation is optional.

-

Accounting software accurate recording of actual purchases and sales is not optional

The jurisdiction requirement for calculation of capital gain on asset sale is hard enough without Manager making it more difficult to manually implement.

That is indeed where both belong. I have been asking this for currency for years so this would be excellent. Recently one of our businesses in Nigeria got in trouble with the tax authorities because of the current treatment where they thought we were buying and selling things in forex within the country which is forbidden. We explained that the loans where given in forex equivalent and that therefore the “value” given the volatile nature of the Naira was very negative, especially as last year the currency got a big hit and again this year and thus debt value increased. As most of this debt is unrealized it should not be in P&L.

I think that unrealized gains should be treated as period end adjustments and reversed at the beginning of the next period. So, maybe a separate report that calculates unrealized gains.

Once calculated reversing journal would be:

DR Asset - Unrealized Currency gains

DR Asset - Unrealized Investment gains

CR Equity - Currency revaluation

CR Equity - Investment revaluation

Again i want to suggest that providing users with the ability to use custom unrealized gains/losses and realized gains/losses accounts would improve the accounting for investments.

Each investment could choose an account from any category of the Chart of Accounts (Equity, Liability, Income, Expenses, and Assets) to record unrealized gains, with another separate custom account for recording realized gains.

The challenge lies in handling unrealized gains after an investment or a portion of it has been sold, which involves recognizing the gain or loss as realized and automatically adjusting the financial statements accordingly.

Yes

Unrealised gains need to be recalculated after sale of same investments. The same method as at end of a financial period can be used.

After the Sale: A worksheet can be used to calculate the necessary figures for adjustments. An option to post the results from the worksheet could be included to implement these calculations.

I’m unsure of the feasibility of this and any complications that might arise, but I believe the genius @lubos could have a eureka moment.

This flexibility I’m suggesting would make Manager compliant with international accounting standards. Forcing every user to use built-in accounts would not make it compliant with all standards, as the standards for investments are primarily about presentation.

The key outstanding requirement is for Manager to have the functionality to enable a user to specify a

-

custom account for unrealised gain (both balance sheet adjustment & corresponding Profit and loss

Unrealised investment gains(losses)accounts) -

A separate

At costinvestment account and it would be nice if it supported a customInvestment at costbalance sheet account (and later if Manager support for calculation of realised gain was added, a user selected customRealised gains (losses)account could be added)

I appreciate NG Software may feel it is difficult to justify the resources to make inbuilt support for realised gains which meets all jurisdictions requirements. However support of only the above would enable users to manually calculate realised gain consistent with local requirements without explicit Manager support of each option (although the structure would not preclude it being added later).

For Australian share investors, they are required to comply with the Australian tax office requiements

and

As a result the investor can

Manager does not directly support tracking individual share parcels at cost pricing when selling, so this must be done in an external spreadsheet. Reconciling the external calculations with records in Manager requires Manager having an at cost account. Without an at cost account in Manager, manually calculating both realised and unrealised gains is required to ensure the ATO requirements are reliably calculated. Which a pity as Managers implementation of unrealised gains is really neat.

@lubos it would be very helpful to know if Manager is unlikely to support custom (separate) Balance sheet & Profit and Loss accounts for unrealised gains. If Manager is unlikely to have this functionality, that fine, Manager is very capable so can support investments via other functionality.

You could hold the share investments as individual lots for example NWS News Corporation Lot 1, NWS News Corporation Lot 2, etc

This means creating separate Inventory Items for each lot/parcel of shares.

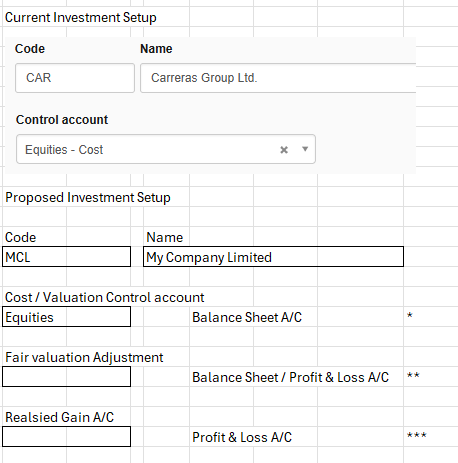

Could I recommend the following changes to potentially solves the problem.

Code Name

| MCL | | My Company Limited |

Cost / Valuation Control account

| Equities | Balance Sheet A/C (1)

Fair valuation adjustment

| xxxxx | Balance Sheet or Profit & Loss A/C (2)

Realized gain account

| yyyyy | Profit & Loss A/C (3)

(1) Balance Sheet (Account type Set) - Current market valuation recorded here.

(2) Balance Sheet or Profit & Loss A/C - Optional to satisfy regional / personal requirements.

Would be automatic.

(3) Profit & Loss (Account type Set) - Movement in value from purchase / last valuation date.

See Snippets for Proposed Setup and expected results from proposed setup changes.

Okay, so here’s from a degreed (bachelors) accountant in the US.

TL;DR: Users have a wide range of reporting and compliance requirements, so would ideally have the option of valuing investments at fair value or cost, and be able select their own income/expense account for unrealized gain(losses) on fair value securities.

Under US GAAP (Generally Accepted Accounting Principles) securities can be split into two major categories as far as their treatment: debt (bonds, etc,) and equity (stocks). They are accounted for as follows:

Debt:

- Held-To-Maturity: these are debt securities that are intended to be held for the life of the security (to maturity); changes in fair value (unrealized gain/loss) are not recognized for these securities, they are recorded at cost when purchased, and amortized (the difference between price and face value) over the life of the security.

- Trading: debt securities purchased with the intent of selling them at a gain in the short term; these securities are recognized at fair market value on the balance sheet, and changes in market value (unrealized gain/loss) are posted to a net income account(s).

- Available-For-Sale: these are debt securities neither held to maturity or trading, they may be sold in the short term, depending on market conditions, or they may be held long term; these are recognized on the balance sheet at fair market value, and changes in market value are recognized in Other Comprehensive Income, a para-income statement report, that reconciles net income to changes in equity.

Equity: equity securities can be available for sale or trading, but both are recognized at fair value on the balance sheet, with changes in value recognized in net income.

However; many small businesses are not required to adhere to GAAP, and are only concerned with reporting to management/ownership and to the IRS (income tax): for income tax purposes all securities are recorded at cost and income is only recognized when interest is paid (and I think when there is a difference between face value and purchase price of a bond.

So, I think that users would ideally have the option of valuing investments at fair value or cost, and be able select their own income/expense account for unrealized gain(losses) on fair value securities.