Dear Admin, I have come across an interesting situation, i hope i am able to explain it, though I have found an adhoc solution but admin may like to review it.

I have a sub business/inventory location created and sale the products from there by transferring the products from main bussiness to that sub bussiness/inventory location. Once a sale is made at the sub-business same is entered in main.

Today I received the Credit not in that sub-business (inventory location). Once I entered same credit note in main business, instead of taking in the sub-business/inventory location it took to main business.

Please look into it if problems is understood.

Regards

You are misunderstanding inventory locations. They are not sub-businesses. They are simply locations for inventory items. Using them in transactions affects where item quantities are added or subtracted. But that does not affect anything to do with financial obligations. Therefore, you do not make a sale at the sub-business. You only indicate where goods will be delivered from.

Additionally, inventory location selection options appear according to context. If you do not have goods receipts and delivery notes enabled, the field appears on sales/purchase invoices and debit/credit notes. If you do have them enabled, the option appears on goods receipts and delivery notes.

If you received a credit note from a supplier, you should have entered a debit note.

I make it simple, I sold from inventory location A, once received credit note, I shud have the option to put in inventory location A or any other inventory location.

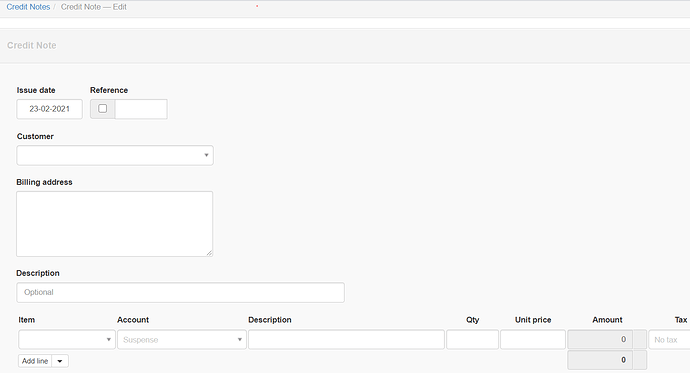

Please see screen shot, option of inventory location shud be there.

Yes, I have enabled the delivery and goods receipt tabs.

I will make it simple, too:

- If you receive a credit note, you do not enter a credit note. You enter a debit note. A credit note for another business is a debit note for yours. You only issue credit notes to customers.

- Select inventory location on the goods receipt or delivery note, not the credit or debit note. This is because once you enable Delivery Notes and Goods Receipts, quantities moving to and from those locations are controlled by the delivery notes and goods receipts, while financial aspects are controlled by the credit and debit notes.

So, if you really issue a credit note, you must issue a delivery note. If the customer is sending items back to you, rather than receiving only a price adjustment, you must enter a delivery note with negative quantity. And if you receive a credit note, you must enter a debit note, then a goods receipt with negative quantity.