There is a bug with handling of early payments when an early payment discount has been offered, a credit note has been issued that is unrelated to the discount, but the full amount is paid in time. To illustrate, consider the following event sequence:

-

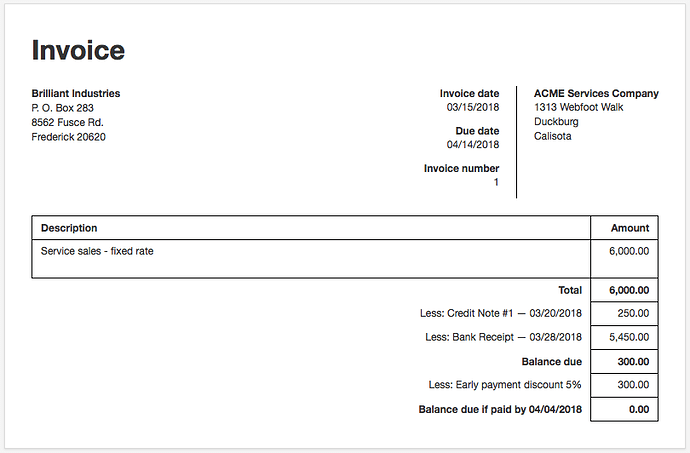

Sales invoice is raised on 03/15/2018 by ACME for 6,000 in services to Brilliant Industries. Terms are net 30, so due date is 04/14/2018. 5% discount is offered for payment within 20 days.

-

A credit note is issued to Brilliant on 03/20/2018 for 250 as a rebate. At this point, terms of the discount are not altered. Under some circumstances, that might be acceptable. In others, such as when merchandise is returned, it would not be.

-

Brilliant pays 5,450 on 03/28/2018. This is the original total, minus the credit note, minus the 300 early payment discount.

At this point, the invoice accurately reflects all the transactions:

However, in the Sales Invoices tab, the invoice still shows 300 due. And the notification of sales invoices eligible for early payment discount via a credit note does not appear:

and a drill-down on the invoice balance shows the discount was never applied, despite its appearance on the invoice itself:

I suspect this may happen because a credit note already exists before the receipt qualifying for the early payment discount was entered.

So there are two problems:

- Failure to reduce the early payment discount when the balance due of the sales invoice is adjusted for some reason before receipt of payment.

- Failure to notify that an invoice is eligible for a discount so a credit note can be created.