Recently, tax accounting changed on credit notes created in response to receipts against sales invoices with early payment discounts. Previously, when creating a credit note in response to the banner:

![]() ,

,

the remaining balance due on the sales invoice was treated as tax-inclusive. Whatever the balance due of the sales invoice was after entering the reduced receipt ended up as the total for the credit note. And the sales invoice was perfectly zeroed out. This is illustrated in the Guide: Record early payment discounts on receipts for sales invoices | Manager.

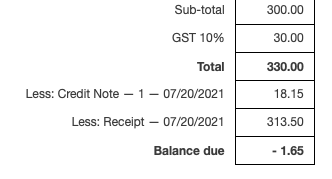

Now, possibly coinciding with removal of the early payment designation and description on the credit note form, the tax-inclusive treatment no longer occurs. So any applied tax code adds to the total value of the credit note. In turn, that results in the sales invoice that offered the early payment discount being overpaid. Today, following through the same example used in the Guide above, the sales invoice mini-statement shows:

The prior automatic designation of the credit note as originating from an early payment discount:

apparently used to override any tax-exclusive option under Form Defaults for the credit note, ensuring that the transaction was treated as tax-inclusive. Whether the explicit designation is restored or not, the behavior needs to revert.

The problem is especially insidious because the credit note form is never displayed. From the review screen, the user is taken directly back to the Sales Invoices tab listing, bypassing both Edit and View for the credit note.