The latest version (25.10.24) is adding a Negative inventory clearing account.

Previously, if you were looking at your financial statements and your closing Qty owned was zero or negative and total cost was not zero, Manager would make an automatic entry to your Inventory - cost account on the profit & loss statement.

For example see this topic:

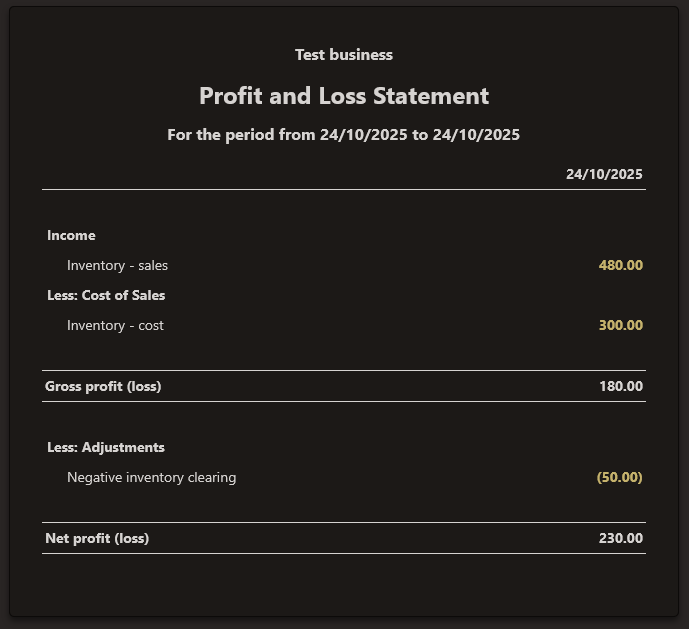

It turns out this wasn’t an intuitive approach because upon drilling down to the Inventory - cost account, it wouldn’t be obvious where these entries are coming from. To solve this issue, I’ve added a new Negative inventory clearing account which will ensure we are not mixing up regular cost of goods sold transactions with negative inventory adjustments.

Let me demonstrate how it works.

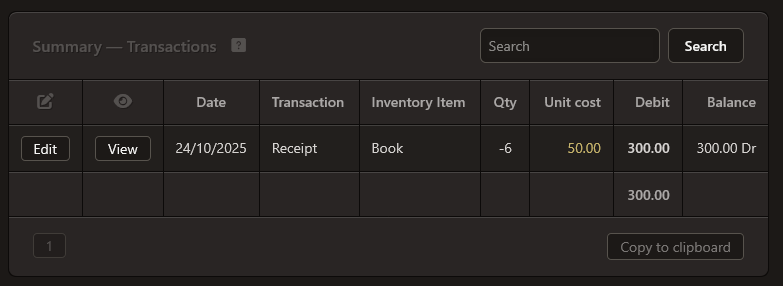

Let’s say we have purchased 5 books and sold 6 books.

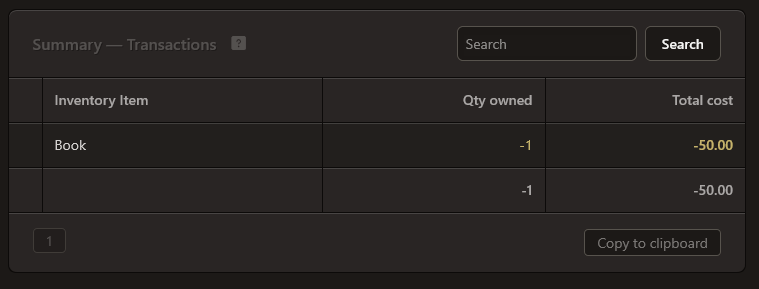

The resulting Qty owned will be -1.

And here is the ledger for Total cost.

We have purchased these books for $50 each and since we sold one extra, our inventory value will be negative $50.

Manager will make an automatic entry to debit $50 so that the balance ends up as $0 (we do not want to show a negative inventory value on the balance sheet).

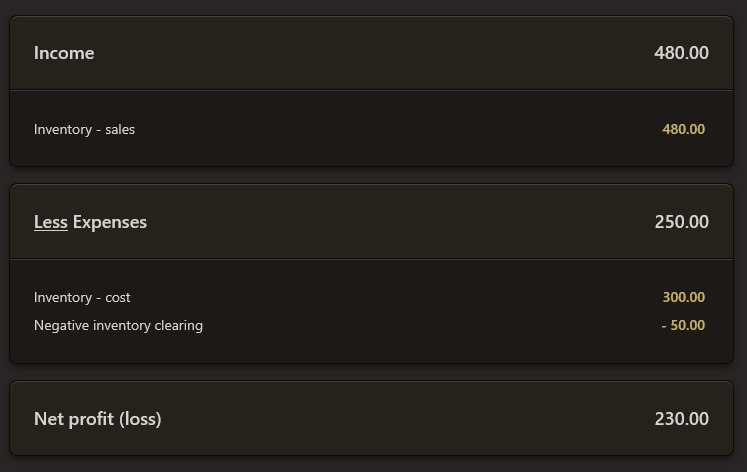

Previously, this $50 would be automatically posted to the Inventory - cost account, creating confusion. So instead of mixing regular cost of goods sold transactions and these negative inventory adjustments, we will separate it.

When you click on Inventory - cost, you will see:

And when you click on Negative inventory clearing, you will see:

Drilling down into the Negative inventory clearing account is presented differently so we can see more context. Also, Qty owned and Total cost are clickable on this screen so you are not at a dead end and can examine further what’s behind these figures.