I have been using manager since 2016 and it is a very supportive tool for my business accounting purpose as i have zero accounting background. Also recently i received your support mail when my system had crashed and could revive all my data of past two years. It was a big relief else I had no solution on earth to bring back all my business transactions back to normal.

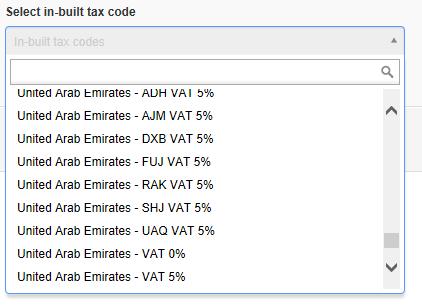

I reside in UAE and now i have an issue with VAT as not able to understand how to make correct entries. Please guide me on the following

-

I am entering VAT 5% on every purchase and sale (is this correct or i should do tax inclusive for all my purchases as seen in some articles of your forum)

-

My earnings is showing negative balance (-415) as of now and when i highlight it shows 5% for every entry which i understand is not correct as each purchase invoice has different amounts paid for VAT

-

Vat payable is not displaying any figure while i have charged in all my sales

-

Not able to change Invoice head as TAX invoice and have to enter separately in Description section

-

How will i be able to get VAT returns file automated in the software as we need to submit to tax authorities before 28th Feb

Please guide me how can i correct myself as i am really concerned and do not want to leave your software and migrate to tally. Thanks