Hi, I am wanting to use Manager to track my personal receipts for taxes and download CSV files for all the different credit card control accounts and import them. I have been able to import things but am wondering how best to set up categories or divisions and whether or not to do that manually in Manager or Excel. Say I have a Business Expense category and a Vehicle Expense category with different sub categories for each, where should I set this up? Is this done in Chart of Accounts or would I have manual references to each category and then setup the master category as a Division or Reporting Category? Say I wanted to designate which person made the transaction, would I just setup two separate control accounts for Person 1s CC and Person 2s CC? I am not an accountant just trying to make end of year taxes a bit more palatable. Would appreciate some guidance here. Thanks!

The new https://www.manager.io/guides and old https://www2.manager.io/guides Manager guides can be of some help.

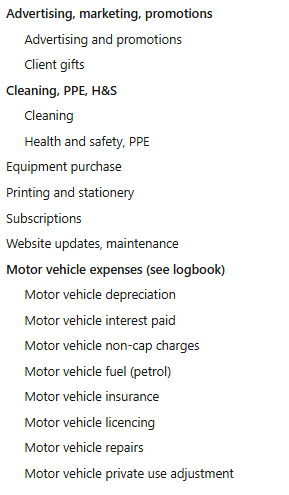

I don’t use Divisions myself, but using Groups in the Chart of Accounts is a very good start to make things clearer.

e.g.

Groups can also have Groups inside them.

This is helpful. Perhaps Divisions is more useful for a larger group with different departments or something.

I see with Receipt Rules I can update the account category retroactively and I guess on import of statements if rules are pre-existing. Is there a way to have the account category just added to the CSV file for import and have it auto populated without a rule?

Have a look at Batch Operations in the guides. That might do what you need. Also, Find & Recode is useful when you want to move a large number of items from one account to another.

How do you recommend designated receipts that are non-deductible? Just leave them as Suspense or create a separate category in chart of accounts for them? Or delete.