When using invoices, I didn’t think the financial transactions to settle the invoice was taxable (VAT / GST).

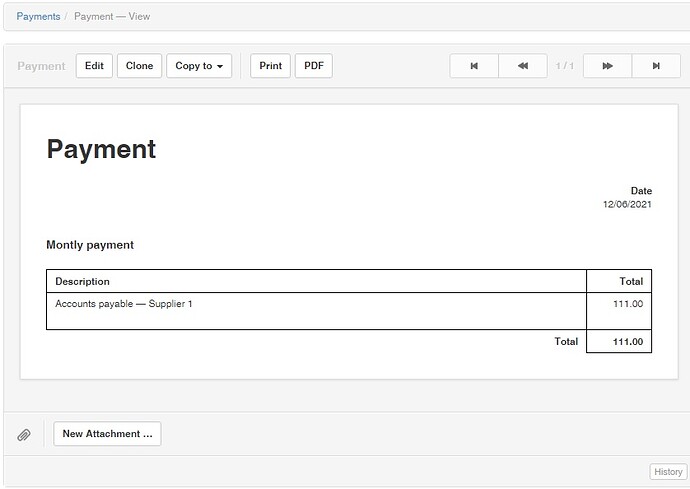

The current user interface appears a little confusing to me.

I think not showing the option to select a tax code when accounts payable or accounts receivable is selected for a line item would be more intuitive.

Past users have found showing it confusing, and the financial implications of using it have caused issues for some users in the past.

Currently a tax code can be selected in the edit screen, a total including the tax code is created however examination of the view screen suggests the tax code is ignored, as are the totals including tax code.

in both cases the view screen ignores the tax code

Similarly for receipts

and again the tax code is ignored