I am adding PayPal to my business’s new website. They charge 2.9% + $.30 as a transaction fee. Their policy does not allow me to charge the customer for this fee.

I operate with prepaid accounts for customers. I input them into Manager as Accounts Receivable. As an example, a customer sends $100 and I log it as an Accounts Receivable receipt for $100, however, PayPal is actually only going to transfer $96.80 to my business account…

How do I properly account for this discrepancy to my ledger? Do I need to create a “PayPal fee” payment every time I create a PayPal deposit receipt for the customer’s $100? Should I create a separate Expense Account for this to make it easier to claim as a bank fee tax deduction at the end of the year?

This would be so much easier if I could just pass on the fee to the customer. Then I could simply warn them their $100 payment will be credited to their account as $96.80!

Correct. Setup an expense account for the PayPal fees, then when you receive the money, record the receipt for the full receivable, then add a line for the PayPal fees expense account and enter the amount as a negative.

Also, from an accrual accounting perspective, if your customers are paying you before you provide any service or product, these should be recorded as deferred revenue liabilities instead of receivables. Since you are a single member LLC, you may not have to use full accrual accounting; check with your tax practitioner for the best way to record those prepayments.

As written, this sounds like it will not properly credit the customer’s account. If they send $100, then their Accounts Receivable should be credited with $100. I see no reason to show them on their invoice that we are paying PayPal for a transaction fee. Adding the line, as your example, would do that.

Since I am a SMLLC, I am doing my own taxes. This is a bootstrap home business. I am running Manager as Cash basis. Plus, previous advice (months ago) suggested I simply log them as Accounts Receivable.

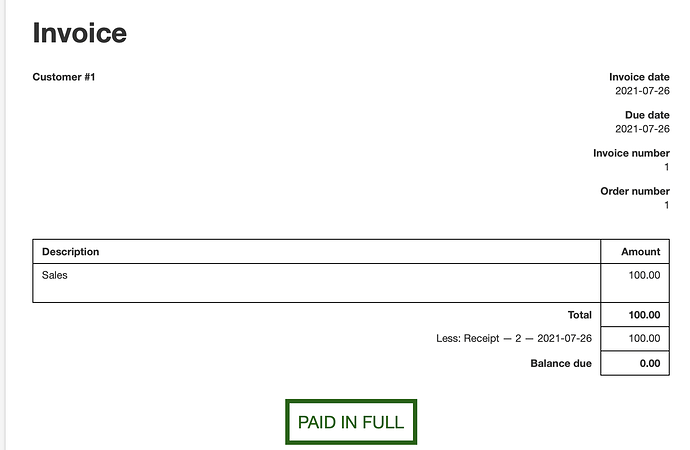

This is how to record the PayPal expense through the Receipts tab. It will not show through on the customers’ actual finalized invoice. Below is how the invoice shows when selecting “View” after recording the Receipt.

I am a layman just learning the ropes of basic bookkeeping in Manager. I am pleased my expense account idea was correct. However, what I was planning on doing is to process the receipt to credit the account. And then create a separate “Payment” for the fee to the expense account. I was just hoping it wouldn’t require a two-step process.

Okay. Please disregard my last. This looks okay as long as the customer gets proper credit and my business (unfortunately) has to expense the fee while not showing on the customer’s receipt. It DOES make it a more streamlined process. Thanks!