Yes everything is included in official guide given previously in forum

No idea how that is supposed to help someone develop a solution. It basically says you are on your own as local users are not interested in doing the work required. Which is very different to @Syed_Salman_Ali contribution above.

it is like this generated by Chatgpt using technical guide.

{

“info”: {

“name”: “FBR Digital Invoicing Sandbox API”,

“schema”: “https://schema.getpostman.com/json/collection/v2.1.0/collection.json”

},

“item”: [

{

“name”: “Validate Invoice Data”,

“request”: {

“method”: “POST”,

“header”: [

{

“key”: “Authorization”,

“value”: “Bearer {{token}}”,

“type”: “text”

},

{

“key”: “Content-Type”,

“value”: “application/json”,

“type”: “text”

}

],

“body”: {

“mode”: “raw”,

“raw”: “{\n "invoiceType": "Sale Invoice",\n "invoiceDate": "2024-05-16",\n "sellerBusinessName": "Business Name",\n "sellerAddress": "Rawalpindi",\n "sellerProvince": "Punjab",\n "buyerNTNCNIC": "1234567890123",\n "buyerBusinessName": "John Doe",\n "buyerProvince": "Sindh",\n "buyerAddress": "Karachi",\n "invoiceRefNo": "",\n "items": [\n {\n "hsCode": "99260000",\n "productDescription": "OTHER",\n "rate": "17%",\n "uoM": "KG",\n "quantity": 100,\n "totalValues": 1170.00,\n "valueSalesExcludingST": 1000,\n "salesTaxApplicable": 170,\n "salesTaxWithheldAtSource": 50.00,\n "extraTax": 75.00,\n "furtherTax": 90.00,\n "sroScheduleNo": "SRO123",\n "fedPayable": 0,\n "discount": 0,\n "saleType": "Services",\n "sroItemSerialNo": "1"\n }\n ]\n}”

},

“url”: {

“raw”: “https://gw.fbr.gov.pk/di_data/v1/di/validateinvoicedata_sb”,

“protocol”: “https”,

“host”: [

“gw”,

“fbr”,

“gov”,

“pk”

],

“path”: [

“di_data”,

“v1”,

“di”,

“validateinvoicedata_sb”

]

}

}

},

{

“name”: “Post Invoice Data”,

“request”: {

“method”: “POST”,

“header”: [

{

“key”: “Authorization”,

“value”: “Bearer {{token}}”,

“type”: “text”

},

{

“key”: “Content-Type”,

“value”: “application/json”,

“type”: “text”

}

],

“body”: {

“mode”: “raw”,

“raw”: “{\n "invoiceType": "Sale Invoice",\n "invoiceDate": "2024-05-16",\n "sellerBusinessName": "Business Name",\n "sellerAddress": "Rawalpindi",\n "sellerProvince": "Punjab",\n "buyerNTNCNIC": "1234567890123",\n "buyerBusinessName": "John Doe",\n "buyerProvince": "Sindh",\n "buyerAddress": "Karachi",\n "invoiceRefNo": "",\n "items": [\n {\n "hsCode": "99260000",\n "productDescription": "OTHER",\n "rate": "17%",\n "uoM": "KG",\n "quantity": 100,\n "totalValues": 1170.00,\n "valueSalesExcludingST": 1000,\n "salesTaxApplicable": 170,\n "salesTaxWithheldAtSource": 50.00,\n "extraTax": 75.00,\n "furtherTax": 90.00,\n "sroScheduleNo": "SRO123",\n "fedPayable": 0,\n "discount": 0,\n "saleType": "Services",\n "sroItemSerialNo": "1"\n }\n ]\n}”

},

“url”: {

“raw”: “https://gw.fbr.gov.pk/di_data/v1/di/postinvoicedata_sb”,

“protocol”: “https”,

“host”: [

“gw”,

“fbr”,

“gov”,

“pk”

],

“path”: [

“di_data”,

“v1”,

“di”,

“postinvoicedata_sb”

]

}

}

}

],

“variable”: [

{

“key”: “token”,

“value”: “YOUR_SANDBOX_TOKEN_HERE”

}

]

}

urls are these

This collection includes:

• POST /validateinvoicedata_sb

• POST /postinvoicedata_sb

Is every taxpayer eligible to obtain their own security token, or must certain entities be registered as licensed integrators to acquire one?

No, not every taxpayer is automatically eligible to obtain their own security token. Eligibility depends on factors like the jurisdiction’s regulations, the type of security token, and the issuer’s specific requirements. Security tokens are often treated as securities and are subject to securities laws, meaning that issuance and trading are often regulated.

As explained in the guide, there are two integration options:

- Proceed with PRAL as a Licensed Integrator

- Proceed with another Licensed Integrator

If the first option is available to all taxpayers, then we can develop our own application or extension to support this integration.

For the second option, taxpayers are required to contact a licensed integrator and utilize their services.

The guide you provided is different from the one shown here.

Which guide should we follow? Because the two appear to have different instructions.

If we are to follow the guide you shared, I already have a Postman collection along with an active security token ready for testing in sandbox environment.

I believe that we should adopt a method in which we do not need any third party and we can integrate directly with the FBR.

THIS is HS Code Guide

yes it is perfect if you say i can share my sandbox token so you can do testing

we will go with 1. option as PRAL is the original developer of ths program and getting token keys through this method is easy. Also first option is available to all taxpayers they just have to apply for tokens

That sounds promising. If all taxpayers can easily obtain a token, there would be no need for a third party (Licensed Integrator) to enable the integration, and we could implement it directly within Manager Extension.

i tried to make an app using loveable which is accessible at https://fbr-invoice-portal-sandbox.lovable.app you can test

I am a non IT person, i want to integrate Manager.io with FBR invoice integration, how i can use the app which you have created?

Very nice, also share some instructions to have that Bearer Token.

Could anyone please confirm if you’ve successfully obtained the Security Token for the integration?

During the token request process, were you required to add an IP address?

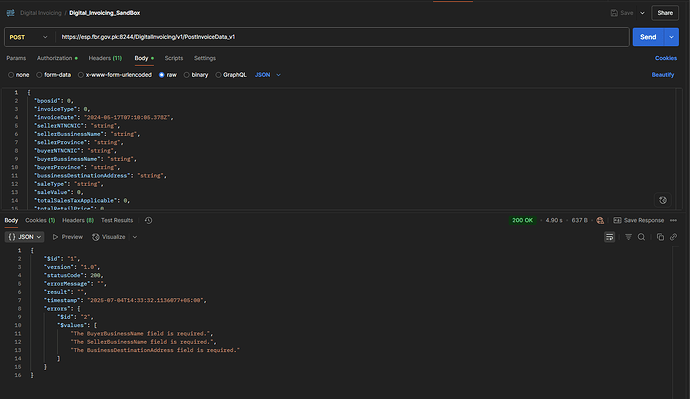

I’ve created a draft extension for integrating Manager.io with the FBR system, but I still don’t fully understand how the communication with the FBR server works.

The documentation mentions two different endpoints — one for validation and another for submission — but it’s unclear how they function in practice.

Also, I’m not sure whether the same endpoints are used for both the Sandbox and Production environments, or if they are different.

If anyone can help clarify how this process works, I’d really appreciate it. Thanks in advance!

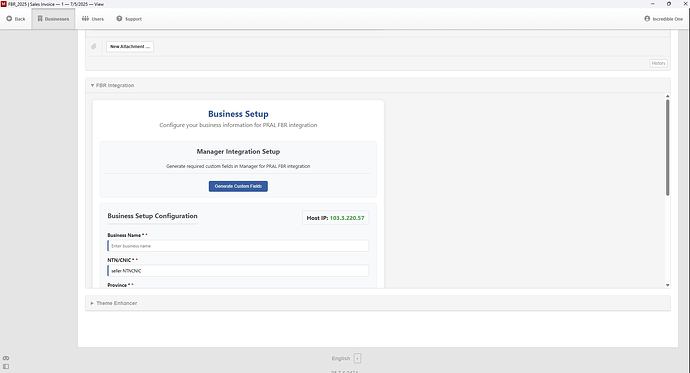

If you’re interested in trying it out, you can add the extension as shown in the image below.

Please note that this application is not fully functional yet.

Do not use this extension on real business data.

Instead, test it with a new business entity and check whether the Custom Fields are created successfully in your environment.If you notice any issues or have ideas to improve this extension,

feel free to send me a private message directly.

@uzair94 Please advice.

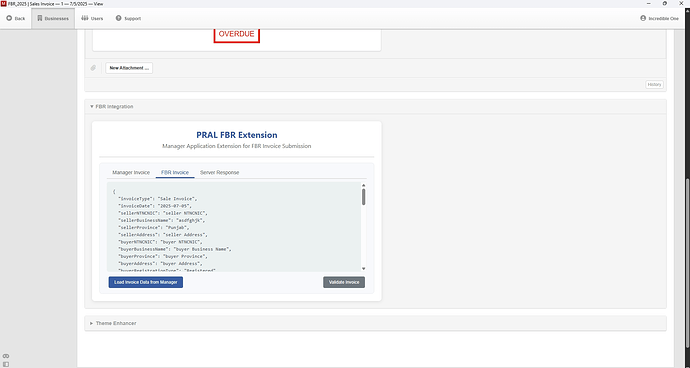

tested its working, and generating custom fields in business details. ![]()

will update you in this regard