Hi, I run a small electronics design company, and I’ve been making extensive use of Manager for its inventory features for some time now. I’m trying to make sense of the new Inventory Revaluations feature and its implications for my accounting. Up to now, I’ve had an intuitive sense for how to deal with inventory and manufacturing: I enter a purchase order for components, and they appear in my Inventory on hand assets account. When I create a production order to turn some of those components into a manufactured gadget, the components are deducted from Inventory on hand, the finished gadgets are added, and they’re ready to enter into a sales invoice for my customer.

I understand that under the new way of doing things, purchases of inventory will not flow to the Inventory on hand account without an Inventory Revaluation, and it’s been suggested elsewhere that I should do this revaluation once per accounting period. My challenge though is, sometimes I’ll purchase components, enter manufacturing and sell finished gadgets to a customer, all within the same accounting period. Without some way to get these components into inventory, I can’t make a production order using those components. It seems there are only two ways to restore the old workflow that made sense for me:

- Do an inventory revaluation after every purchase order, or

- Do an inventory revaluation before every production order.

Either way, I’m having trouble getting this to work. I created a test business using version 23.10.25.1106, with a simplified version of an actual production run we did this year. (I intended to upload the test business here, but I’m blocked by the fact that new users cannot upload attachments.)

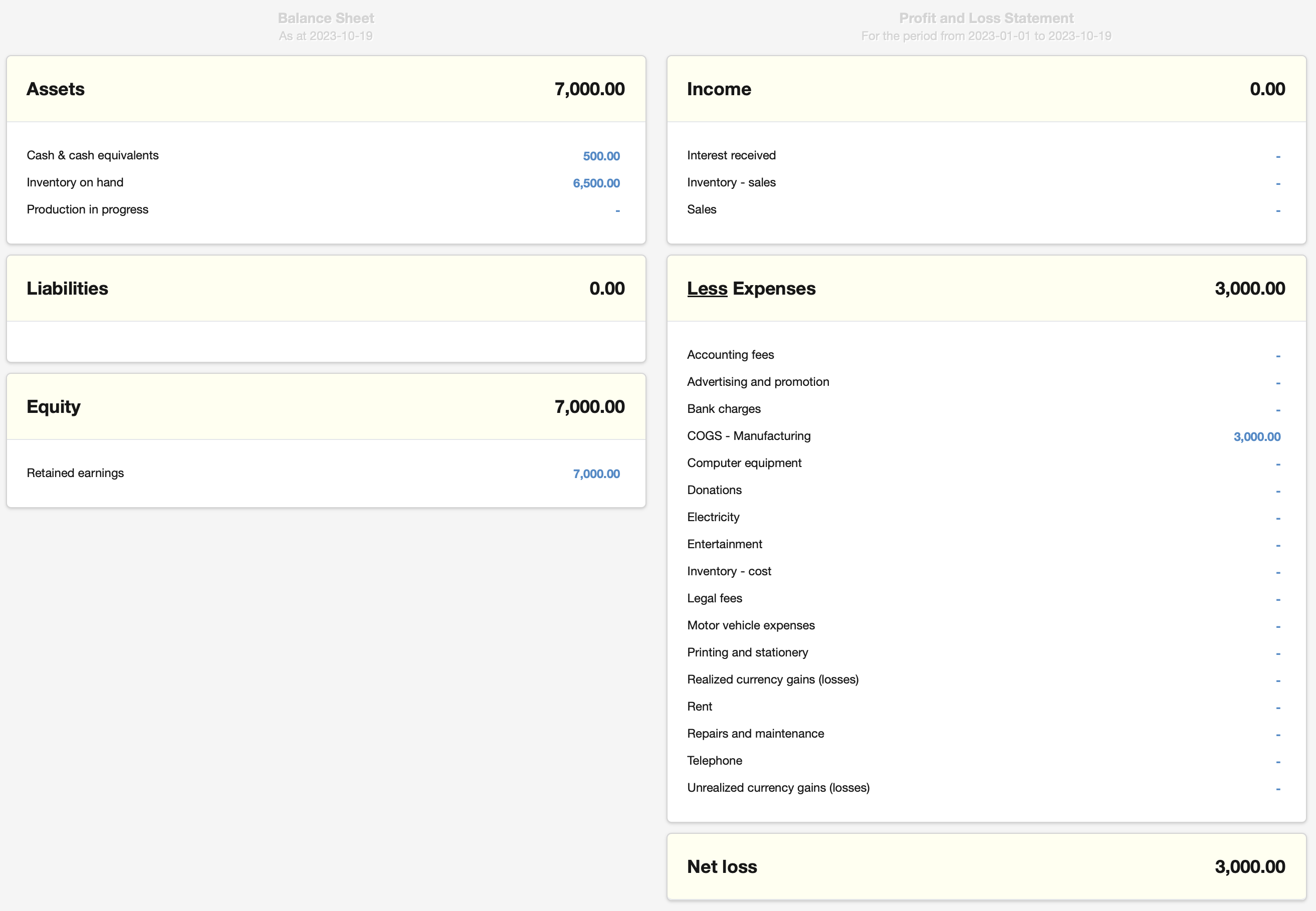

In this example, we purchase 1000 circuit boards, 4000 of component A, 2000 of component B, 8000 of component C and 10000 of component D over the course of one month (9/1 to 10/1). We also enter a payment to our manufacturer on 10/16. As of 10/17, those transactions all show up on the expenses side, which is expected under the new way of doing things. Knowing that we’re going to manufacture on 10/20, I generate an Inventory Revaluation Worksheet on 10/19, and create an Inventory Revaluation with that information. This correctly moves the inventory to Inventory on hand as of 10/19:

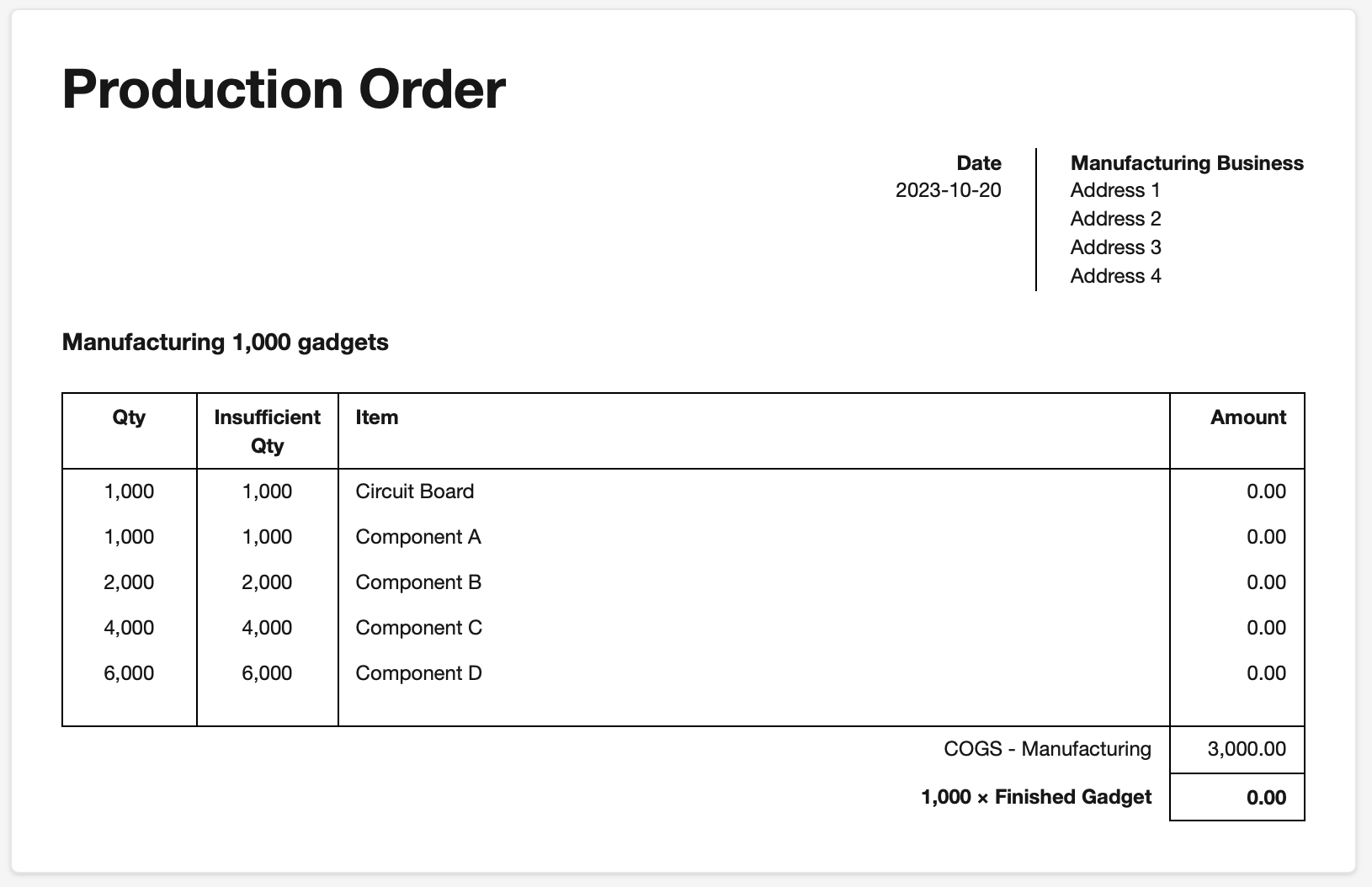

But then when I create the production order on 10/20, it shows as having insufficient quantities of all components:

Is this a bug? And whether it is or not, what’s the best way to get purchased inventory into the Inventory on hand account on a rolling basis, so that I can make production orders? I understand the intention behind removing the Dynamic Rolling Recalculation, but is the only alternative running many manual revaluations after every purchase, and before every production run?