How can i invoice my finished production item?

I’m sorry but your issue is not that clear.

Can you explain more? with examples?

Thank you for your email.

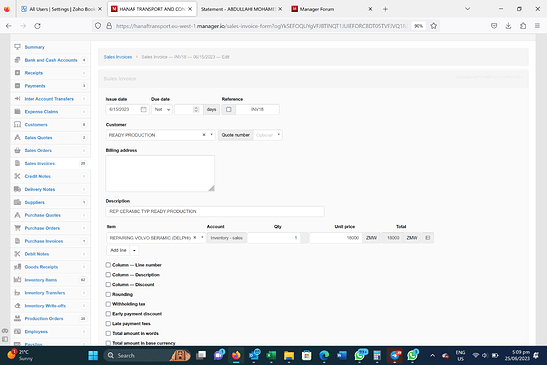

I did production as you can see in the photo below.

After that I would like to sell these products.

See the next Photo.

When I go to report profit and loss, it will be totally different.

My inventory sales and Inventory Cost are almost the same.

My finished productions are not linked to my sales.

I don’t know what to do!!!

That is completely due to the your sales prices for inventory items as entered on sales invoices and their average cost at the moment of sale. There are no bugs in Manager’s calculation of this. If you want your sales to exceed your costs, you must sell at higher prices.

Your confusion may originate with the fact that you have apparently defined a repair service as an inventory item, which violates several accounting principles. You cannot hold a repair service in inventory, because it is not a tangible good. Now, if you are reconditioning used parts for sale, that is a different situation. You would have acquisition costs for the used parts, which would be inventory items in their own right. You might have other inventory parts, such as new gaskets that would also be part of the bill of materials. It would help if you would fully explain the business situation and workflow involved.

You also should not be adding profit as a non-inventory cost. Profit is the difference between income and expense, definitely not a provision in the cost of inventory items.

Yes, they are. Income from inventory items you produce show up in the Inventory - sales account. You should read the Guides about production orders and managing inventory.