Hi Guys,

I am doing my tax and when I printed out my General Ledger Report - every line in every invoice I have issued is listed. How can I change this so it just lists the actual invoice?

cheers

Pete

Hi Guys,

I am doing my tax and when I printed out my General Ledger Report - every line in every invoice I have issued is listed. How can I change this so it just lists the actual invoice?

cheers

Pete

You can’t. The General Ledger report reports on General Ledger transactions which by definition are line by line.

One invoice could post to more than one G/L account

It isn’t quite clear what you need - why does your tax report need G/L transactions which come from a variety of sources other than invoices eg payments, receipts, journal entries, debit and credit Notes, expense claims, payslips, etc

Thanks Joe for your reply and sorry for the slow response.

My accountant asked for me to print out my G/L report.

That’s when I noticed every line of my invoice was in the GL. I write detailed descriptions in my invoices so it is a bit bizarre to see them in my GL report.

I would have assumed it would just recorded the invoice total - given that is the transaction. Thats what used to happen when I used MYOB.

I couldn’t see how to print out a report with just my invoices. Is there a way?

Cheers

Pete

That is a misconception. The invoice is a particular presentation of one or more general ledger transactions, each of which debits one account and credits another. A typical single-line sales invoice would debit Accounts receivable (and the customer’s subsidiary ledger) and credit an income account. If your accountant believes an invoice total, which might summarize many transactions, is a transaction, you need a new accountant.

If you want a list of sales invoice amounts, your best approach is to search and sort the Sales Invoices tab as desired, copy to clipboard, paste into a spreadsheet, then make any further organizational changes needed.

Thanks Tut,

I did get a new accountant and the first one wanted the GL report - all 42 pages, print outs of my bank accounts etc. The accountant seemed to be very “old school” including going to pub every lunchtime for 3-4 beers - so I did change accountants and now the new is was the one asking about the individual entries from the invoice.

Also another strange thing is when I pull up my PL report the building materials appear in brackets - whilst in expenses - I don’t know why that is. Do you have any ideas?

Cheers

Pete

Well, I can only reiterate that each line item on a sales invoice is a distinct general ledger entry: debit to Accounts receivable under the customer’s subsidiary ledger (or subaccount), credit to the designated posting account. So that is how things will show in the General Ledger Transactions report.

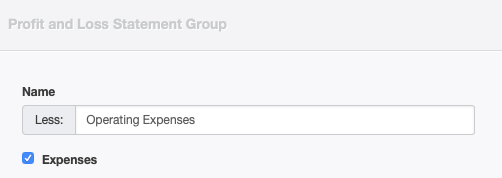

The answer depends on how you set up your chart of accounts and whether you entered transactions correctly. Groups in the chart of accounts offer a checkbox for Expenses, like this:

If you check it, that group shows under a a “Less: XXX” heading, like this:

![]()

Normal expense account balances will show as positive numbers. In that case, a negative balance (in parentheses) indicates the account balance is in credit, which indicates there have been contra entries. This might happen if you received a refund from something you reported as an expense in a previous year, as an example.

If you don’t check the box, the group heading will omit the “Less:” prefix, and normal debit balances will show as negative numbers. That is, they will all be in parentheses except those with contra balances. The selection is a matter of personal preference, but the first option is more traditional, because accountants are used to seeing both income and expenses on a profit and loss statement as positive numbers. But there is no reason any experienced accountant should be confused.

The bigger question is whether the balance of the account really is in credit, that is, is of the opposite sign from what you expect. This would happen if you are entering transactions incorrectly, such as using sales invoices where you should use purchase invoices, or receipts where you should be entering payments, or entering quantities and unit prices on any of those as negative numbers (which is only occasionally correct).

Thanks for your fast reply Tut,

I made the adjustment as suggested and checked the boxed - it made no difference.

I was introduced to the Manager Software by a friend - who has run a couple of businesses- he set me up and showed me how to use the program - entering expenses, chart of accounts, bank rules and creating invoices.

Sometimes, I buy materials on account, sometimes Eftpos, credit card, paypal. Sometimes, I don’t use all the materials on one job. Sometimes, I use stock items such as glues or nails. I have just been writing up the sales invoice - with the labor under Building Income and then materials under Building Materials in expenses.

I am just a carpenter and sole trader not an accountant - I have not investigated whether I should be using purchase invoice. This seems to be confusing. I converted to computer accounting in 2000 using MYOB First Accounts - never had any issues and the accountants were happy. This is my third year using Manager, my last accountant was happy for the first two year - now there seems to be some questions.

Hopefully - I got things right

Cheers

Pete

Unfortunately, you may not have gotten the materials right. By including them on a sales invoice and posting that line item to an expense account, you effectively told the program the customer was buying materials from you that you had purchased for yourself as a consumable supply and charged as an expense. So they show up as a contra expense. From an accounting perspective, you might instead have treated those materials as inventory. Or you could treat them as a billable expenses. One way or the other, they are showing up as negative expenses because you have not properly accounted for their acquisition costs. You should discuss with your accountant whether these items should be treated as inventory or billable expenses.

Thank you Tut - you have been a great help once again!

cheers

pete