When I try to enter freight-in unit price value it does not show in the amount (greyed) column. If i enter with quantity than it reflects in amount column. Pl any one can explain why it is happening and where is the mistake in purchase invoice.

amount = quantity x rate

so if you leave quantity as blank it is assumed as zero.

The guide specifically says to leave the quantity blank when allocating Freight-In.

I’m having the same problem but it only appears to happen on Purchase Invoices with a large amount of small cost items. An early entry today that only had to spread the freight out over 3 items with larger costs seemed to work fine.

When I went to enter a parts order for items we manufacture (first time I’ve done this in Manager), I had 9 inventory items with a total of 675 total pieces, al of which are under $1 each. I chose Freight-In as my ‘inventory item’, left the quantity blank and put the shipping total ($16.99) into the Unit Price box all as I had done in the previous Invoice. This time the ‘Amount’ box stayed gray and wouldn’t allocate the freight. Too many items causing too many decimal points in the costs?

Ideas?

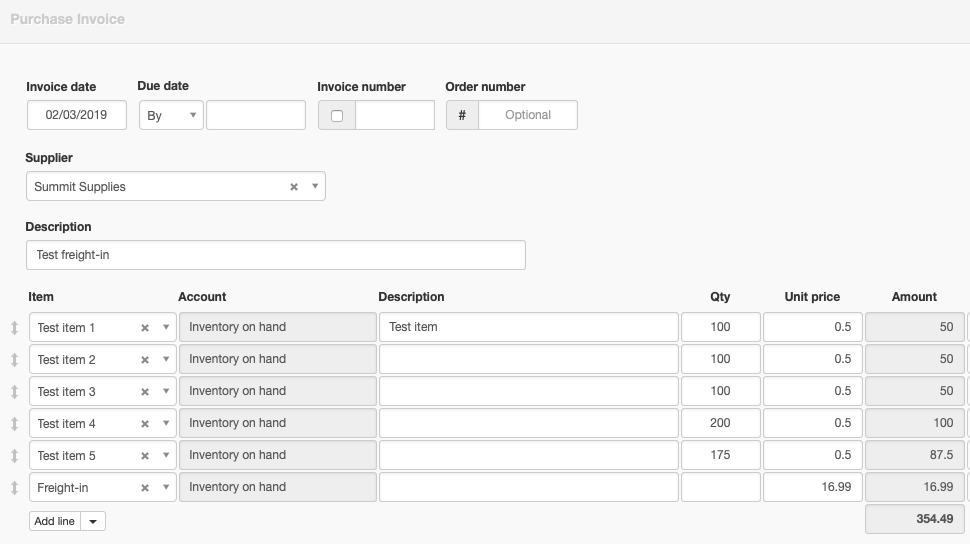

I cannot reproduce this problem. I entered five different items, all with unit prices of $0.50. There are 675 total units. With $16.99 of freight-in, the average cost should increase from $0.50 by $0.02517 each. The purchase invoice looks like this:

and the resulting average cost looks like this:

Allowing for rounding, this is exactly what should be expected. Are you sure the quantity is blank and not zero?

Yes, I was careful about that and that’s what confused me. I needed to get finished so I made a new COGS account for product shipping and applied it to that. BUT - just to frustrate me, I went back after your e-mail and changed back to Freight In and this time it worked. Sigh. I love the gremlins in my system, truly . . . .

Think I’m going to continue to use the Shipping - Product account I made anyway, at least for small parts since I’m concerned about ongoing rounding issues which will likely crop up over time.

Thanks for your help.

Understand that, if you do what you describe, shipping costs will not be included in average unit cost. For that to happen, the freight charges, however applied, must be posted to Inventory on hand. You can do it one item at a time or use the freight-in item and have it automatically distributed. But you cannot allocate freight to another account and have it included in average cost. You should think hard about what you want average cost to include. This will affect profitability calculations, as well.

Hi,

Above solution is ok if the freight is added in the purchase invoice.

But in my case, the freight invoice and customs duties are other supplier.

I want to distribute the freight cost and other incidental expenses to cost of the inventory.

Im talking to almost 50 inventory items in one purchase invoice.

Do you have any soultion on this.

Yes, @hya. Read the Guide: Add freight-in to inventory item costs | Manager. See the section on entering separate freight-in charges.

The Guides should always be your first resource when you have questions.

Hi,

Thanks for your reply.(very helpful)

This is OK if the purchase invoice currency is same as the currency of the freight/duties.

We usually purchase inventory items in EUR and local charges in AED.

Any comment or solution on this?

Thanks

Liza

There should not be any issues. Currencies do not apply to inventory items, they apply to the various suppliers involved. As long as the purchase and freight costs are both assigned to the same inventory item, Manager will make the conversions.

Hi @Tut,I’m using the Freight In method to add to the average cost of Inventory Items as explained in the last example in your Guide " Enter the freight-in charge as a negative number in Unit price." I have to create Two Invoices, one for the Supplier, and one for the Freight Service.

I’ve got 2 questions regarding the Freight In feature.

-

Is the Freight In Cost included in the " Inventory Cost " figure under the " Less Expenses " table on the " Summary " page? I imagine this will affect the " Net Profit " total. I’m not sure whether the Freight In charges are part of the final calculation, since as per the instructions in your Guide, I am supposed to assign the Freight Costs for all Freight Invoices to a Special Clearing Account which, when done properly, has to have a balance of Zero.

So, is the Freight Cost included in the Expenses when using this method? -

How can I view/print out the Freight Costs as a report?

Yes, after an inventory item has been sold. Before the item is sold, it is included in the asset account, Inventory on hand. The accounting principle involved is that inventory costs include all expenses of acquiring them, including freight-in and non-offsettable taxes (if any). Unsold inventory items are assets until you sell them, much like money in a bank account. You are holding them for the production of income. After you sell them, their full cost is transferred to Inventory - cost to reduce the profit in the income account.

Let me explain why you use a freight clearing account. The freight-in item, when added to a purchase invoice, distributes the freight costs proportionally across all items purchased on a single purchase invoice, based on their costs. That feature is very convenient, but it is only available on purchase invoices showing the quantities purchased and prices. In other words, it only works on the original purchase invoice from the supplier of the goods. It doesn’t work on a purchase invoice from a shipping supplier, because there are no quantities of inventory items being purchased from that supplier.

So, if you use that feature on the original goods purchase invoice, you are increasing it beyond what the supplier actually invoiced. Therefore, you need the negative entry to get the total back down where it matches the supplier’s invoice. That is the amount you post to the clearing account. Now, when you enter the shipper’s purchase invoice, you also post that to the clearing account. Only then will the clearing account balance be zero.

The freight charges are added to the average cost of the inventory items when you add the freight-in item to the original purchase invoice, the same way they would be if the goods supplier billed you directly for shipping. The shipper’s invoice never touches inventory item costs. The freight costs are initially assets, just like inventory purchase costs. When the items are sold, they become expenses, the same exact way purchase costs do.

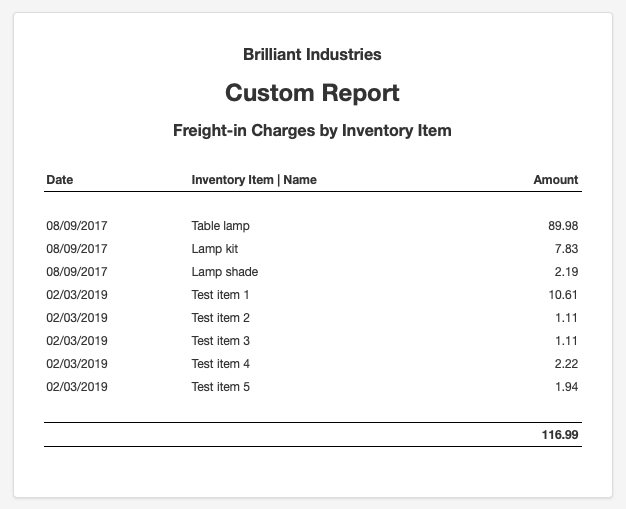

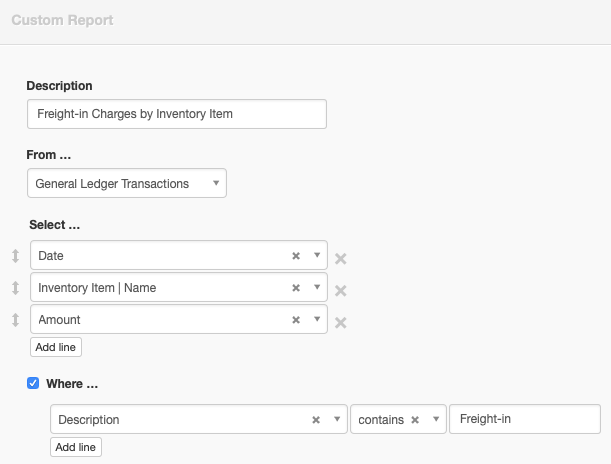

There is no built-in report that shows this, because the freight-in costs are added to average cost of inventory items in Inventory on hand. But, there is a workaround. If you enter a line item description of Freight-in (in addition to the item name) on all freight-in charges, the following custom report will generate something useful:

The report lists the freight charges that have been applied to each inventory item on a date. This example has two purchase invoices with freight-in charges:

You could also experiment with grouping to get totals or add other information.

This comment does not make sense if you have understood @hya comments:

1 - “I want to distribute the freight cost and other incidental expenses”

2 - “I’m talking to almost 50 inventory items in one purchase invoice”

3 - “We usually purchase inventory items in EUR and local charges in AED”

That is, they have an inventory Suppliers invoice with 50 items listed and a freight-in Suppliers invoice with only a few items (freight cost and other incidental expenses) listed.

In another words, the freight-in Suppliers invoice doesn’t list the 50 items so for your comment to have validity the user would have to re-list the entire 50 items on that invoice in place of the existing few items.

@hya read this lengthy topic Importing of goods - #36

It explains how to use multi currency and clearing accounts to achieve your outcome.

The Guide at the end details the process but notes various limitations which are misleading - this has been explained to those responsible but it appears that they aren’t interested in correcting the false guidance…