I have done some research and this is what the law in my country says about adjustment on tax on invoices due to some event after issuing the tax invoice. And below is what it says

Adjustments 45.

(1) This section applies where in relation to a taxable supply by a taxable person (a) the supply is cancelled; (b) the nature of the supply has been fundamentally varied or altered; (c) the previously agreed consideration for the supply has been altered by agreement with the recipient of the supply, whether due to an offer of a discount or for any other reason; or (d) the goods or services or part have been returned to the supplier.

(2) Where in addition to the conditions in subsection (1), the taxable person making the supply has (a) given a tax invoice in relation to the supply and the amount shown on the invoice as the tax charged on the supply is incorrect because of the occurrence of any one or more of the events mentioned in subsection (1), or

(b) filed a return for the period in which the supply was made and has accounted for an incorrect amount of output tax on that supply because of the occurrence of any one or more of the events mentioned in subsection (1), the taxable person making the supply shall make an adjustment as provided under subsections (3) and (5).

(3) Where the output tax properly chargeable in respect of the supply exceeds the output tax actually accounted for by the taxable person making the supply, the amount of the excess shall be regarded as tax charged by the person in relation to a taxable supply made in the tax period in which the events referred to in subsection (1) occurred.

(4) For purposes of subsection (3), the taxable person making the supply shall issue to the recipient of the supply a tax debit note containing the particulars specified in the Fourth Schedule and in the form specified by the Commissioner-General.

(5) Subject to subsection (6), where the output tax actually accounted for exceeds the output tax properly chargeable in relation to that supply, the taxable person making the supply shall be allowed a deductible input tax for the amount of the excess in the tax period in which the events referred to in subsection (1) occurred.

(6) For purposes of subsection (5), the taxable person making the supply shall issue to the recipient of the supply, a tax credit note containing the particulars specified in the Fourth Schedule and in the form specified by the Commissioner-General.

(7) A deductible input tax is not allowed under subsection (5), where the supply has been made to a person who is not a taxable person, unless the amount of the excess tax has been repaid by the taxable person to the recipient, whether in cash or as a credit against an amount owed to the taxable person by the recipient. (8) A person who (a) fails to provide a required tax credit note or tax debit note; or (b) provides a tax credit note or tax debit note otherwise than as required by this section is liable to

(a) a penalty of three times the amount of tax involved or two hundred and fifty currency points whichever is greater; and

(b) the penalty imposed under section 58,

What I make out of this is that

-

Manager.io is doing this correctly as expected by country tax rules.

-

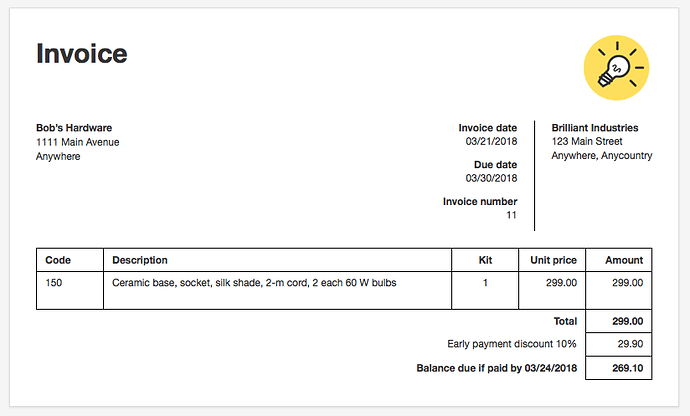

The credit note would have to be titled a Tax Credit Note if the Invoice is titled a Tax Invoice

-

If A tax credit note won’t be issued, The cash discount amount must be an expense and the tax component wont change as i suggested earlier and therefore the reduction on amount receiveble wont cause a reduction on the tax amount receivable.

So the credit note approach which is a legal document which changes amount receivable on an invoice is what is needed to also change the tax component as Manager is doing correctly.

- If I want my cash discount offered to show as an expense and leave the sales amount intact, I can edit the credit note and change the accounts from the sales accounts selected by default by the credit note to the desired expense account (Cash Discount Account) and the same effect is what i will see.

So going forward @lubos, you have to let the description of the Credit note show if a user is in the credit note tab

No field for description in credit note

The benefit of showing the description is that. It will enable the user to easily search and find credit notes which were issued for cash discount using the search box and this text “Early payment discount”. The user can then change the accounts to an expense account if they wish or for any other purpose (Tax audit, External Audit, final adjustment etc)

Does anyone think i’m misinterpreting the tax law i pasted above? Please comment