We are a smallish business that is growing and with that trying to ensure we improve our procedures. The other day I went through some things with our bookkeeper and stressed the importance of verifying the liability accounts etc. When I looked into the withholding tax there were some things that didn’t make any sense to me.

Now I’m 99% sure this is due to us doing something incorrectly and with that perhaps uncovered a bug or some unintended behavior. Whatever the solution is, I’m sure it will be embarrassing, but hopefully I learn something

If I look into another supplier that we pay in Tanzanian Shillings, everything is normal (expense account: Cleaning supplies):

For this USD supplier again things are normal (expense account: Website):

For this landlord it gets funky. Everything was fine on the old transactions, but on some of the newer ones the Purchase invoices show up in “debit” as well.

When I’m looking through this some of the “debit” amount seems to be related to unpaid amounts. Is this normal?

For example on Purchase invoice number 24248, it was credited 1,111.11 USD to the Withholding tax payable account and also current date debited 240 USD which is 10% of the amount still due.

I feel like I’m sniffing the problem, but can’t put my finger on it. Something related to the due dates or payments.

This might get a little bit disconnected.

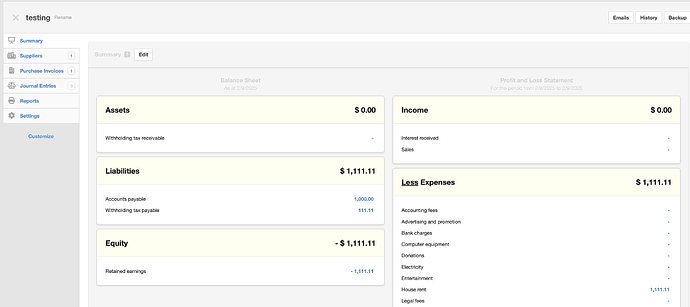

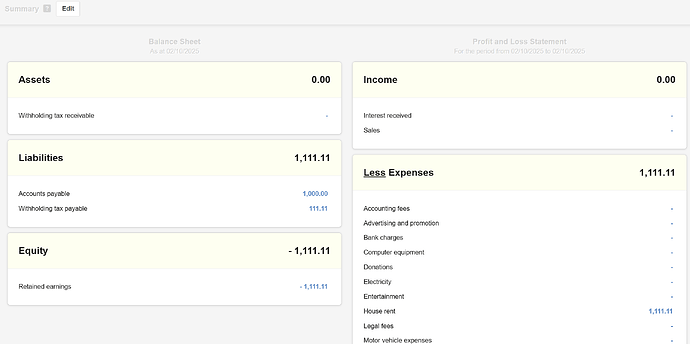

But if I go back to my example of purchase invoice 24390 (Test number 4), the summary looks like this:

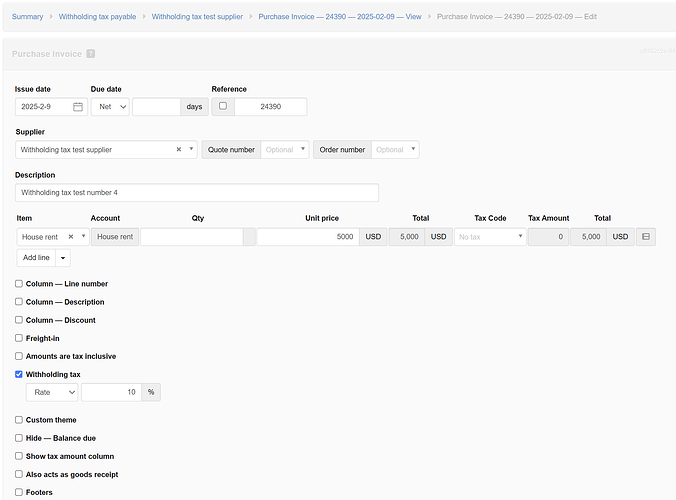

Edit screen for purchase invoice 24390:

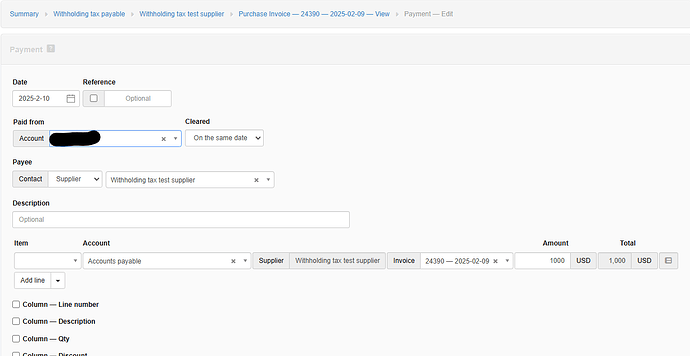

If I make a new payment:

Then the summary looks correct (I think):

I apologize if this is a bit confusing, I started of trying to answer @Ealfardan and as I kept going I thought I figured something out, then not, and now I’m just confused.

Not sure if this was helpful or if it explains something or not.