Please note that Starting balances are used only when migrating accounting for an entity to Manager from a prior accounting system.

yes, I migrated from older software to manager on Jan 1st, 2024.

please help me with this problem below :

for example, I had a supplier named ABC with my remaining payable amount of 200000 in my older accounting software and then I shifted to manager. now how can I post my partially paid invoice amount (200000 remaining balance) in manager.io. how to show an opening balance of suppliers. the links you provided do not ring my bell.

do you have any youtube links regarding this?

If you have financial reports from your previous system, then follow the values listed on your financial report.

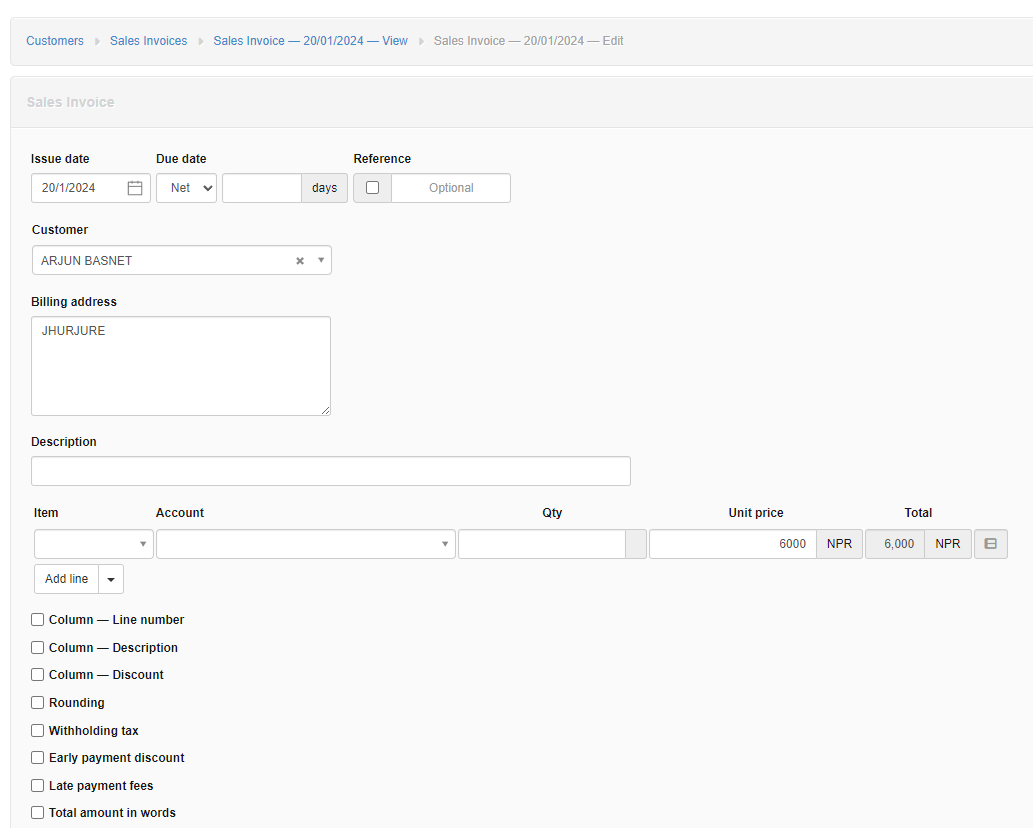

is this the correct way to enter the opening balance of the customers (partial payment received invoice)?

No, the date is incorrect

You need to post the unpaid invoices as of 31 Dec 2023 with the correct dates

Your Summary page should have the period 01/01/2024 to 31/12/2024 for example

This clearly explained in the guides - maybe read them again

Set starting balances for customers | Manager

Set starting balances for suppliers | Manager

You also always need to assign a Balance Sheet account otherwise it will go to Suspense.

that was just an example

I was just asking you about the posting method.

is that the correct way to post the opening balance of the customers?

also, should I post the opening balance of suppliers by creating a purchase invoice like the above by only entering the amount?

which account should i mention there sir?

You need to have a Chart of Accounts with Balance sheet accounts that are similar to your old system. You need to select the account similar to what was used in your previous accounting system.

Also you must read the guides referred to by @Joe91 as they are very clear about your question:

it would be greatly helpful if you guys showed me how it’s done with screenshots.

I am not getting any help regarding my problems with the provided guide links.

it is not possible to enter all my previous invoices and transactions. I just want to enter the remaining balance as an opening balance for my customers and the vendors.

The content in the links is clear. Maybe you should create a test business and experiment. You can also search the forum for further info regarding starting balances. The ending balances and what is still open are available in your old accounting system, similar to open invoices. Your chart of accounts in that system should be replicated in Manager. Yes, changing from one to another is always a learning curve. No-one can provide screenshots specific to your situation. The process is fairly simple and well documented in the Guides. Just take your time reading and implementing them.

In addition regarding:

You need to sum up all outstanding invoices to a single amount and create for that customer or supplier an invoice dated 31/12/2024 with that total amount and assingn it to one of the income (customers) or expense (supplier) accounts that you created in the Chart of Accounts that are similar to those in your old accounting system. Note these should be Balance sheet NOT Profit and Loss accounts (my wrong) because they only related to outstanding balances (what you owe = Liability account and what is owed to you = Asset account. That’s all.

If you enter the customer/supplier opening balance by creating one invoice with the outstanding balance instead of all outstanding invoices then you will not be able to track which invoices have been paid when they customer pays/supplier is paid

The Customer/Supplier statements will not be useful either until the opening balances have been cleared

@Joe91 Thank you, this will be the best way to start the balance of Customers and Suppliers.

Previously I used Journal Entries, but there was a slight problem with debt repayment and receipt of receivables.

@Trader_s_Point_Grow and @Mabaega, your posts demonstrate that you are not reading and following the Guides. Asking for screen shots that are already present in the Guides proves you have not read them. Those already linked by @Joe91 and @eko really are very clear.

which account should I enter while entering the opening balance for the partially paid invoice of this customer?

-

Create accounts in Manager to perform the functionality required going forwards. These will probably be similar to your old accounting systems accounts

-

Post to invoice to the equivalent accounts used in the unpaid invoices.

-

Imo if each customer/supplier has a limited number of outstanding invoices, just copying those invoices is easier and more informative.

I already answered that and mentioned that without it it would as you now show be in Suspense. @Patch just repeated it. Only you can create that account in Chart of Accounts and then assign it. I agree with @Tut that you seem to prefer us telling you here on the form rather than using the Guides.

To me it seems that you are uncertain and changed from an accounting program that worked for you and you knew how to operate it and now are faced to learn a new accounting system with its own challenges. You can not expect Manager to work as your former accounting software but have to learn how to go about things often in different ways. For example Manager hardly uses journal entries but prefers to reduce possible errors by using functional tabs such as Payments and Receipts.

So you may have forgotten but when learning to use your previous accounting application that it required significant time and similar is true for Manager.

It is possible to migrate to a new accounting system at the end of a financial period (past or future) and it is possible to enter past invoices particularly those outstanding at the date you migrate between accounting systems.

Doing both of these is likely to take you less time than fighting to avoid the work, and is far more likely to provide an accounting system your understand. I strongly recommend you reconsider both of these decisions, as doing so has the potential to benefit you very significantly.