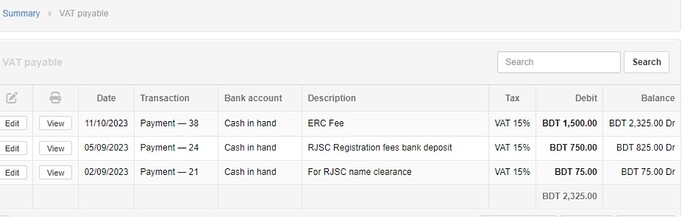

Hello everyone. I am a new user and facing a problem. I paid 15% VAT for licencing my business. Now my VAT payable shows a negative balance. How can I make it zero?

Hello!

I’m not the right person to answer this as to this day debit/credit just flies through 1 ear and out the other.

But basically if I understand this correctly this just shows that if you filed your VAT return now and these were the only transactions, your tax authority would you reimburse you 2,325 BDT.

You had no sales so you collected 0.

You had expenses related to your business that accrued a total of 2,325 in VAT.

Balance will become 0 after your tax authority issues your refund and the receipt is entered into manager.io.

Hi,

I’m not sure why you are paying VAT in the licensing of your business but anyway, anytime you pay VAT, a debit entry is registered on your VAT Payable (tax liability) account. When you sell, a credit entry (payable to the government) is made on your account.

Thank you