Hi Manager Guru’s

I’m still bashing my head on this setup for tracking my personal investment property mortgages.

This question is more about the pro’s and con’s, or feel free to fill me in what I’m missing …

So, I’ve tried dozens of prototypes, but landed with two methods, each having an upside and a downside, or is there another way with just all upsides? I’m all ears ![]()

I’ve been given some advice to either keep all mortgages grouped under a single control account, and other competing advice to have each mortgage under their own control account, I prefer to have them all appear separate on the Balance Sheet, to I’m preferencing separate.

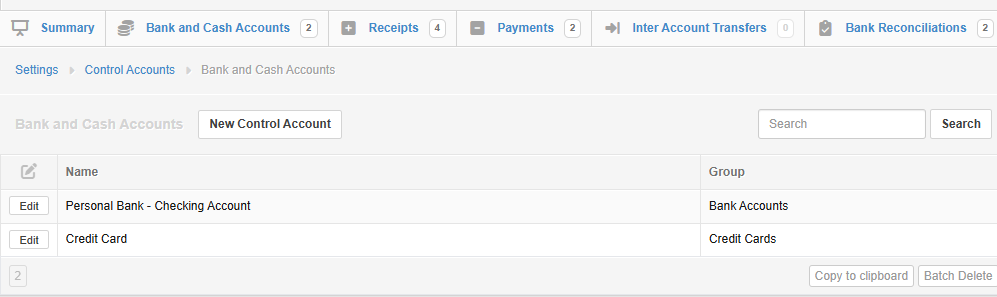

Next advice has been to setup the mortgages as Bank Accounts, put them under their own Control Account & Group in Liabilities. I prefer this as it allows me to more easily use the Bank Reconciliation feature for Bank Accounts to verify if any transactions have been missed, HOWEVER, the big downside, this method doesn’t allow me to do receipt/payment transactions.

I can only use Inter Account Transfers, and this gets worse when trying to make Principle & Interest payments (Principle to the Mortgage in Liabilities as Inter Account Transfer and Interest to the Property Expenses as a stand alone Payment). This is super ugly ![]()

The other method using Special Accounts instead of Bank Accounts can achieve the same outcome on the Balance Sheet per se, and is much easier to make the Principle & Interest Payments, HOWEVER the downside is not being able to setup the Mortgages for Bank Reconciliation.

Is there a different way, which allows both Bank Reconciliation and Payments of Principle & Interest on Mortgage / Bank Loans, please share how this can be done.