Hi all, I have been using Manager as the main accounting software for my small business. Enjoying it. Thanks developers. My trouble is with one sales invoice. I charged customer £450 Plus VAT to provide services. Customer paid £250 as advance payment. I issued the sales invoice and credited my account showing due balance from customer. Now customer said he no longer need services and asked me to refund the money I received from him. I am allowed to deduct my minimum charges which are £60 plus VAT. I refunded to the customer £160. I am now confused to enter this transaction. After searching the forum I tried to write a credit note to the customer and then journal entries but could not succeed. May be I was doing something wrong. I will appreciate if someone here help me out.

First of all, you should not have raised the sales invoice for £450, because you had not done the work, so the customer did not owe you any money. This also unnecessarily raises your taxable income on your books, because this amount is not really income in the accounting sense. The correct approach, if the customer required documentation before paying the advance deposit, would have been to use a sales quote, because it has no financial impact. See this Guide:

https://forum.manager.io/t/creating-sales-quotes/7238

Once the customer paid the deposit, handle it according to this Guide:

https://forum.manager.io/t/customer-deposits-and-advances/7093

Then, when the customer decided to back away from the deal, you need two transactions:

-

A sales invoice for the minimum charges, to which you are entitled. This will be automatically paid from the deposit as long as the deposit was handled as described in the 2nd Guide above.

-

Spend moneyfrom a cash account to refund the remainder of the deposit, allocating the transaction toAccounts receivableand the customer’s subaccount. (That is where the deposit is recorded, as a contra receivable.)

So that’s how you should do things in the future. If, by chance, you never actually sent the sales invoice to the customer, you could delete the errant sales invoice and re-enter everything as above. In fact, in that case you can skip the sales quote step.

But if the sales invoice actually was sent to the customer, you should not delete or modify it, because that would destroy part of your accounting history. (Until it actually leaves the company, it has no real effect.) So the recovery steps will be different. However, until you describe exactly what you did with the deposit, etc., I can’t tell you what they will be. So please provide further information:

-

How did you enter the £250 from the customer? What kind of transaction did you use, and what account did you post it to?

-

How did you enter the £160 refund? Again, what kind of transaction, and which account? And what exactly did you do about VAT, since you say the minimum charges were subject to it, but the £160 makes no allowance for it.

-

What do you mean when you say, “I…credited my account showing due balance from customer?” How did you credit which account?

Until we can sort this out, I recommend that you delete any credit note or journal entries you made. You say you “…could not succeed.” But you didn’t say why or why not. Until we can clarify what you did with the two actual money transactions, everything else is a distraction.

Hi Tut, sorry for the vague statement. I have two accounts: Office account and Customer deposit account. When the customer agreed a fix price I raise the invoice. If the customer paying on hourly basis I deposit money into customer deposit account and when work finished raise the invoice.

In this case the price was agreed and fixed so I raised sales invoice with £450 plus VAT. Sales invoice sent. Against the sales invoice I received £250 and credited my office account.

I issued refund cheque for £160 from office account. I have deleted the credit note and journal entries.

Transactions relating to this transaction are: Sales Invoice £450 plus VAT, Receipt of £250 received in office account, Spend money £160 from office account. Hope I have answered your queries. Thanks in advance for your help.

You didn’t say specifically, so everything I’m going to tell you assumes that Office account and Customer deposit account were created under the Cash Accounts tab. Whether they are accounts at a bank or petty cash funds does not matter. If that is not true, you have bigger problems, because the Cash Accounts tab is the only place Manager can record actual inflows and outflows of money to or from the business. I’m also assuming you are using accrual basis accounting.

When you raised the sales invoice, you should have selected the customer involved, who should have been predefined in the Customers tab. The £450 line item should have been allocated to some income account. I’ll refer to that here as Sales. The VAT tax code should have been selected. If any of those things didn’t happen, edit the sales invoice accordingly. The result would be an increase in Accounts receivable and Tax payable. (As an aside, this is another reason not to raise invoices for work not complete. You will end up remitting more to the tax authority than you should.) The Sales income account should also increase by the same amount.

When you received the £250 deposit, you should have entered a Receive money transaction under Office account, allocating it to Accounts receivable > Customer > Invoice #. That would decrease Accounts receivable. But it wouldn’t do anything to Tax payable, because the deposit has nothing to do with taxes. It also would not decrease the Sales account. If anything about that receipt doesn’t match what I’ve just written, edit it.

Now, create a new credit note. The best way is to copy from the sales invoice. However you create it, adjust the Amount to £390, because that is the amount you are reducing the sales invoice (450 - 60). Make sure the line item is allocated to Sales. Select the same VAT tax code as the original invoice. The result of this credit note is to reduce Sales income and Tax payable by corresponding amounts. It should also reduce the balance due on the sales invoice to zero, because now, the customer has actually overpaid. Finally, it will reduce Accounts receivable. Since you previously sent the sales invoice to the customer, send them the credit note, too.

Finally, we come to the refund. This should have been done with a Spend money transaction from Office account. The transaction should have been allocated to Accounts receivable > Customer, with the invoice number left blank. Assuming there are no other invoices pending with this customer, the Amount should be the balance of Accounts receivable for this customer, which is viewable under the Customers tab. Do not designate any tax code. This amount may not be £160 for two reasons:

- You said your minimum charge was £60. 450 - 250 - 60 does not equal 160.

- You have not figured in the effects of VAT.

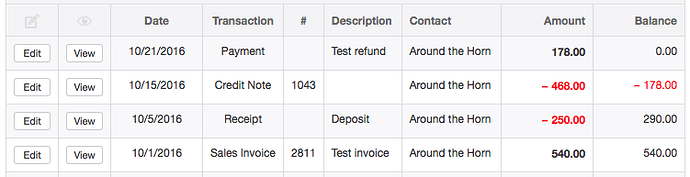

Since I don’t know what your VAT rate is, I assumed a rate of 20% and ran the foregoing series of transactions through an example company for a fake customer (Around the Horn). The resulting entries and running balances in the customer’s Accounts receivable subaccount are as follows:

One caution: you may have mistyped your minimum charge in your original post as £60 instead of £90. That may be where you got your £160 refund amount. If so, the credit note should have been for £360 plus VAT and the numbers in my example would look like this, with a smaller refund:

So, when all is said and done, and with your actual VAT percentage, you may owe the customer more, or you may have overpaid them. If the latter, you might wish to just write off the difference.

Hi Tut, thank you so much for your help. you correctly assumed all the information used above. only difference was my figures which was my mistake. I deducted £75 plus VAT that’s why the refund was £160. Now my accounts are in order. I have few more queries and suggestions which I will raise in a separate heading. thanks.