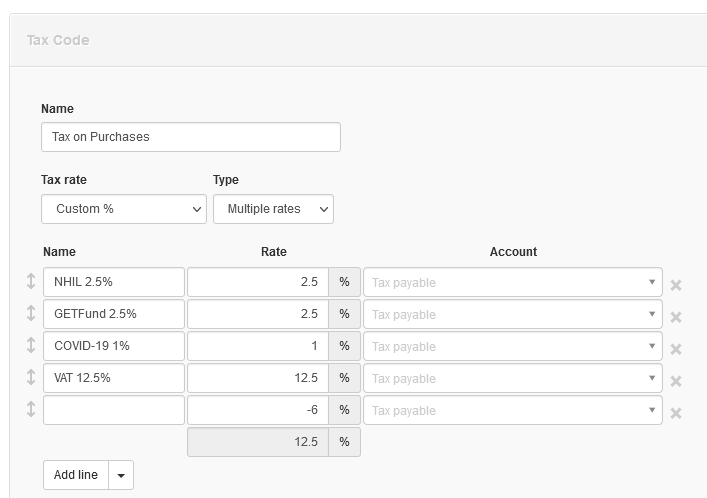

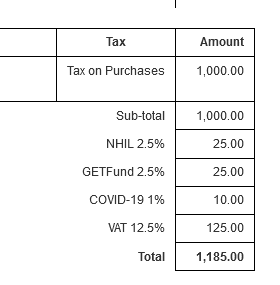

In the latest version (21.11.10), I’ve implemented quite elegant solution to handle this use-case. Here is how you can set up tax code in Ghana for purchases where 1 or more tax components are being charged but not recoverable.

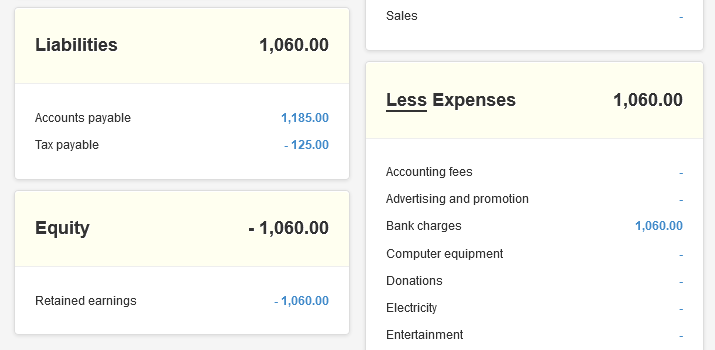

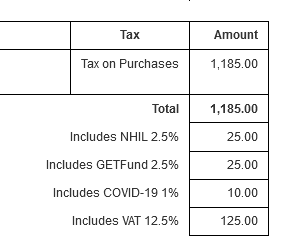

Negative rate handles non-recoverable part. Here is an example how this tax code works on purchase invoice.

But when you look at account balances, you see:

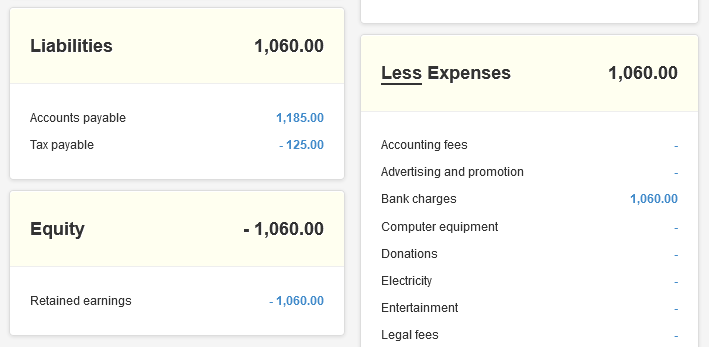

It also works when entering transactions which have tax-inclusive amounts.

And account balances

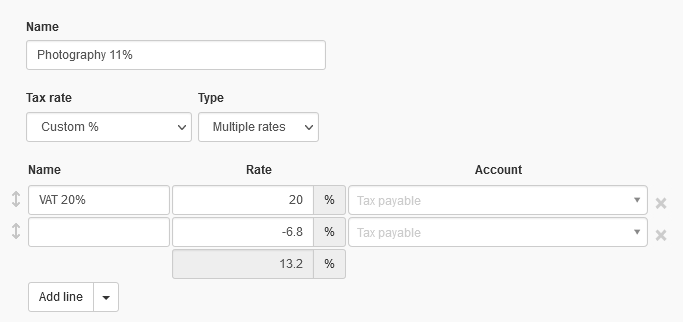

This can also replace Flat rate checkbox which has been so confusing to many. For example, businesses using flat rate VAT in UK could enter their tax code like this:

Why -6.8% and not -9%? It’s because published flat rate by UK tax authority is on tax-inclusive basis but tax rates in Manager are always entered on tax-exclusive basis. VAT-inclusive flat rate 11% = 13.2% VAT-exclusive flat rate.

11% * 1.2 = 13.2%

We can add all UK flat rates into UK localization so businesses wouldn’t have to work this out themselves.