@lubos it would be great to have this. I wish we could have this done before we officially add Ghana tax Codes.

@Abeiku i made a suggestion to have the ability to choose custom income and expense accounts for each tax component separately. something similar to what we have for inventory items.

this would help balance the tax ledger where particular tax components cannot be claimed as input tax credit.

@sharpdrivetek The problem with this idea is that an irrecoverable tax component needs to be added to the expense it relates to. For example, if I pay a consultant for accountancy fees with irrecoverable tax components, It will be better to post the irrecoverable amount to the Accountancy Fee account instead of a designated tax expense account.

If Lubos can add a mechanism to enable Manager to automatically make the entries, it would be very helpful.

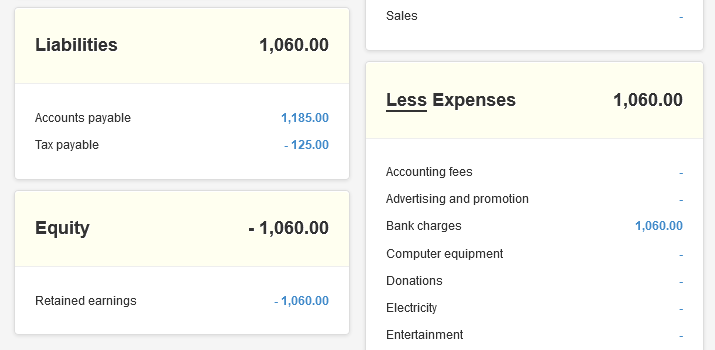

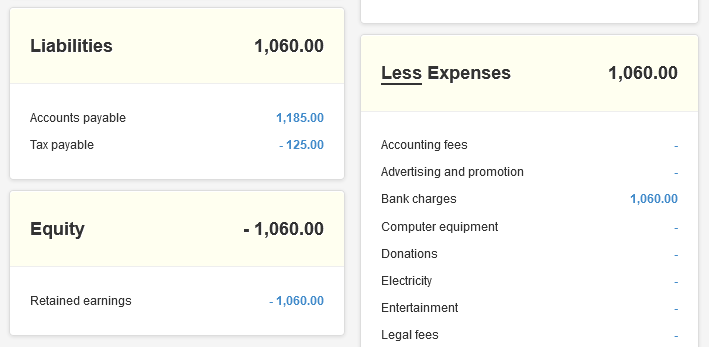

when you have the choice to select different income and expense control accounts, the tax figures are separated rather than offsetting the single control account. proper accounting needs this because the irrecoverable tax cannot actually reduce your tax liability. but in Manager it reduces the tax liability since the present implementation has the tax components using the same account for income and expense.

@sharpdrivetek Yes, I agree,

| STANDARD | |

|---|---|

| Tax Codes | Nature |

| NHIL (2.5%) | Not Deductible |

| GETFund (2.5%) | Not Deductible |

| COVID-19 (1%) | Not Deductible |

| VAT (12.5% on sub total) | Deductible input tax |

For tax with the component above this is how we set it.

We completely remove the levies (NHIL, GETFund and COVID-19 Levy) from the input tax code. Users have to remember to add to the line items.

The limitation forces us to use two tax codes. Output and Input.

so even if Lubos implements the possibility to fetch tax components, how are you planning to generate reports for individual tax components if you add them as line items? i am just curious because i have been scratching my head over it for few days now ever since localizations had started.

We add the levy (NHIL, GETFund and COVID-19 Levy) amount to the line items only when entering input (purchases) but the component is part of the tax code in output tax. No filing is required for the levies on input tax, you must file returns only for the VAT code itself ( Input Vat of 12.5%).

You are required to file returns for levies on output tax

I hope I have answered you.

@Abeiku my understanding is that tax code for Ghana to be used on Sales is working fine.

The issue is with Purchases side where you are being charged 2.5% but 0% is recoverable.

It’s similar how Flat rate works in UK and other countries where you are charging customer 20% VAT but government is going to collect from you reduced rate - e.g. 3% VAT. So that difference goes to income account rather than balance sheet account.

On Purchases side in Ghana it’s exactly the same except the rate you can recover is 0%.

The issue is that purchase tax code in Ghana requires 3 tax components and flat rate concept is not supported on multi-rate tax codes. But if I add this, then this scenario would be fully supported.

Is this all correct?

Yes, I think that would work. I have a feeling a componentised tax code with some or all tax components flat rated is wanted by some users also so kindly add that and let run tests.

this is where our use case differs. we have to file in both cases.

@lubos since you are planning something on this I will give you a heads-up for our use case.

for us your suggestion will work but we might have to create separate tax codes for the same. the list of tax codes is already 48 now and this will be doubled.

while we do have purchases from suppliers which cannot be claimed as input credit, we also have goods and services where the tax on them are irrecoverable. so a supplier would invoice a mix of goods and service where input can or cannot be claimed.

my idea is to have a flag which links the tax codes components with inventory and non inventory. a simple flag with Y/N options for input tax credit.

as a default, tax components will have Y selected for tax components.

users would select N on tax components for use cases where tax codes are irrecoverable as a whole.

users will select Y or N for their inventory and non-inventory items. this flag will have higher priority than the flag on tax components. since Manager already has ability to select custom expense accounts for inventory and non inventory, just enabling selection of Liabilities account will work.

if my suggestion to select custom income and expense accounts for tax components is also implemented, i am confident we can reduce the present number of tax codes for my country by half.

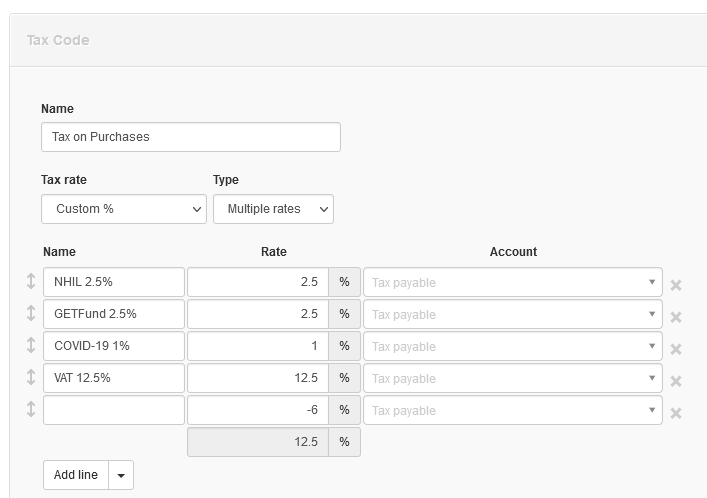

In the latest version (21.11.10), I’ve implemented quite elegant solution to handle this use-case. Here is how you can set up tax code in Ghana for purchases where 1 or more tax components are being charged but not recoverable.

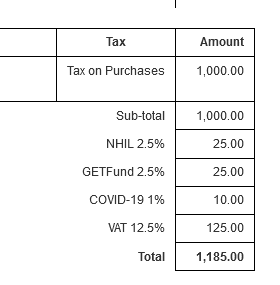

Negative rate handles non-recoverable part. Here is an example how this tax code works on purchase invoice.

But when you look at account balances, you see:

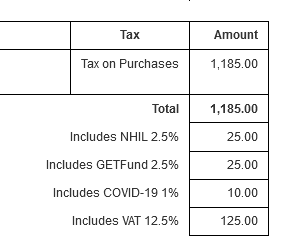

It also works when entering transactions which have tax-inclusive amounts.

And account balances

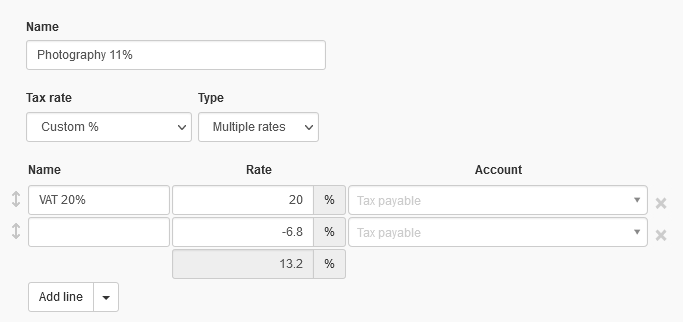

This can also replace Flat rate checkbox which has been so confusing to many. For example, businesses using flat rate VAT in UK could enter their tax code like this:

Why -6.8% and not -9%? It’s because published flat rate by UK tax authority is on tax-inclusive basis but tax rates in Manager are always entered on tax-exclusive basis. VAT-inclusive flat rate 11% = 13.2% VAT-exclusive flat rate.

11% * 1.2 = 13.2%

We can add all UK flat rates into UK localization so businesses wouldn’t have to work this out themselves.

@lubos this is excellent. Only that I have had ideas of using negative numbers to withhold VAT in countries where there are withholding VAT laws, as mentioned here Tax deduction and addition , please Help - #12 by Abeiku

We have a Withholding VAT law in Ghana too but only large corporations and government institutions have been tasked to withhold and pay for now so I guess businesses who suffer the deductions can enter negative amounts as a line item for Withholding VAT Assets.

@lubos can you enable the viewing and cloning of tax codes? It would make setting up of new tax codes when governments make changes to tax rates easy and possibly maintain tax reporting settings without much work.

@lubos

I created tax codes and entered negative numbers to ensure irrecoverable taxes are expensed.

The negative rate amount ensures irrecoverable levies are added to the tax-exclusive amount to compute the total expense which is good but it also adds the amount to the tax-exclusive amount in the Report transformation report, it also somehow adds the negative rate value causing the invoice value to differ from the report transformation amounts. The problem is that a tax return form requires I add the tax-exclusive amount (without the levy element) to tax amounts (levies and vat) to find total invoice value so I need the net purchases without the levies and add them to the tax amounts.

See screenshots below

But it rather reports this:

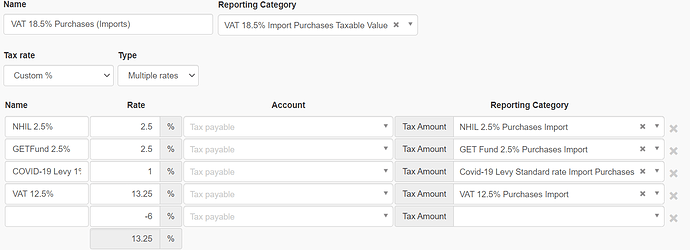

See tax code below

It leaves out the VAT 12.5% (13.25% Effective) in the report transformation report,

You can check the Ghana localisation business data.

I hope I illustrated this well.

There has to be a way to report net purchases (without expenses levies) if there are irrecoverable levies in a tax code for report transformation purposes.

There is. Create one more tax amount reporting category and assign it to negative rate tax component (right now you have that empty). Then if you want Net purchases amount, the field on report transformation will contain two reporting categories.

VAT 18.5% Import Purchases Taxable Value- And your newly create tax amount reporting category which you apply to negative tax component

Adding these two categories together will produce the amount you are seeking.

Ok will test that tomorrow

Hello Lubos, how would I go about tax inclusive flat rate of 35 or 40% given that the formula you use here seems not to apply for flat rates above 20.

@osireg, tax codes are not defined as being tax-inclusive. It is the transactions you apply them to that are designated as being either tax-inclusive or tax-exclusive. See the Guide: https://www.manager.io/guides/9502.

Why do you say that? Tax codes mentioned in this thread may not have been defined for any rate above 20%, but that is not because of any formula. That is only because of how the particular codes were defined.

I am referencing the formula in this example and yes I understand tax codes are not defined as tax-exclusive or inclusive.

There is no formula in the tax code definition you showed.