Dear I’m new in manager I tried to made Pay slips & deducted some amount from employee but its showing deducted amount as payable (Liabilities), but this amount is not liabilities , its like company income. so how can I entry this in Manager so deducted amount will show as others income.

What did you deduct from the employee’s pay?

Payslip deductions are amounts payable to outside entities, like income tax or retirement plan diversions by the employee. See Set up payslip items | Manager.

If you are deducting for items the employee has purchased, search the forum. There have been many discussions about that. Likewise, if you are deducting to recover an advance of salary or wages, search the forum. That has been discussed many times, too.

Because employee borrow some amount from others & employee couldn’t able to return those amount to others. So company paid that amount to others on behalf of employee & now company want to deduct every month partially those amount from employee.

So this was a loan and should have been recorded as an asset. Search the forum for “employee loan,” and you will find many topics on different ways to handle this

Well for example. I paid $ 5000 as advance to employee (I made payment for the employee under “employee clearing account”). so now its advance…

then next month i made pay slips & Deducted $ 455 as employee salary is $ 2450.

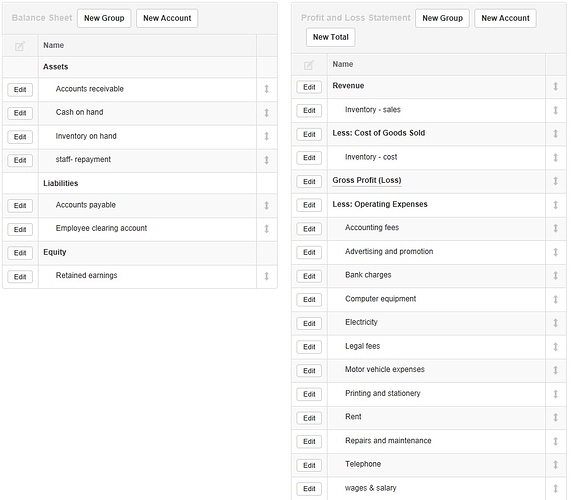

you can see the attached do you think is that ok…

Can you show the edit screen for the payslip deduction item “repayment” ?

What is a bit odd about the payslip deduction item is that you can

- Setup a liability account for example Employee Loans in the Liabilities section of the balance Sheet

- Create a payslip deduction item (loan repayment) and associate it with this liability account

- Switch the Employee Loans account from the Liabilities section to the Assets section on the Balance Sheet (Loans to Employees are an asset not a liability)

- Payslip creation still works correctly!

If you want to keep track of individual loans, then you need a Employee Loan account for each individual

Dear kindly find attached to understand… How can I switch the employee loans from Liabilities to Assets. please assist me

thanks

well, so what about deduction like employee was not available 2 days in his/her duty? so how we will make that pay slip & how we will deduct those 2 days wages that must show in pay slip. is that possible in MANAGER…?.. thanks

This is a totally false statement. There is absolutely no problem with creating a Payslip Deduction item for repayments as the staff member is re-paying / settling a debt. If the debt is with a third party (garnishee wages) or their employer makes absolutely no difference - it is a deduction.

@macmek, when you paid the advance to reimbursed the other employees, you should post the 5000 to the Staff Repayment account, not the employee clearing account. This will give you an asset of 5000. Then each time you deduct 455 within the payslip, this will reduce the balance of the Staff Repayment account.

You don’t, you just change the allocation of the 5000 to the Staff Repayment account.

If the employee only worked 3 days instead of 5 days, then the input for Payslip Earnings item “Salary” is only for 3 days. You don’t input 5 days and then deduct 2.

You are correct. I have deleted the post. There has been a change that I was not aware of. Previously, you could only assign payslip deduction items to liability accounts. That is what the relevant Guide says. Currently, you can assign them to asset accounts, too, making what you describe possible. I am not certain, but I suspect this extra flexibility happened in December 2019 when the automatic Payroll liabilities account was replaced by ordinary accounts. It was not announced at the time. The Guide was changed to cover expanded flexibility for liability accounts, but not asset accounts.

Dear @Brucanna, thanks for your advice. the advance problem solved by your assist. tnx again. take care

According to the screen shot of your chart of accounts, you already have your staff repayment account set up as an asset account.

Dear, just now i saw your reply… thanks waiting until the bug fixed

@macmek, I edited my post. @Brucanna’s technique can be used. In my simulation efforts, I left out a step. @Brucanna’s method is completely correct. I will not be submitting a bug report as I originally wrote. However, there is a labeling problem with asset accounts. I will submit a bug report about that.

@Tut - I have no idea what you are going on about, you have now backflip on your own post two or is that three times.

Firstly, when I said “This was a totally false statement”, I was only referring to the start of the quote “I already told you deductions were for payments to outside entities”, and went on to explain by example that deductions could also be internal. I made absolutely NO reference to any asset or liability account status in the response to the quote.

Yes but no. When creating the Payslip Deduction item you had to allocate it to a liability account, but then you could go to Setting > Chart of Accounts and reassign that liability account to being an asset account and everything work as though the asset account had been originally selected under Payslip Deduction items.

It good to see that that workaround is no longer required. So all we now need is the ability for Payslip Deductions items to be assigned directly to P&L income accounts. Currently the workaround is to create a Payslip Earning items and input negative values.

Two times, I think. The point is, the capability in the program is different from what I thought and what was in the Guide. It’s hard to clean up a thread when there are intervening comments referring to posts that turn out to be erroneous.

Correct on both counts. My references to asset and liability accounts were to explain why I was wrong and how the program now differs from the Guide. (By the way, I initiated a correction to the Guide that will post to the web site within the next 12 hours.)

I also was not previously aware of this workaround. As far as had been announced, payslip deductions could only be assigned to liability accounts. That impression was reinforced by the labeling bug.

Hi Dear all,

Now I’m suffer to entry other deducted things from employee . please see the bellow mentioned …

- Company paid $ 1000 to other on behalf of Employee.

- now company had an agreement with employee that employee will return $ 1350 to Company ($ 350 more then what company paid to other. so let say its like income/asset)

- so the employee will return those amount by payslip (monthly $ 270) & that must show as deducted in payslip.

is that possible in MANAGER ?

THANKS

@macmek, this is exactly the same situation you described previously, with one exception. The additional $350 is income (you might classify it as interest income, although the effective rate would be so high it might legally be considered usury in some jurisdictions). Since you cannot allocate a payslip deduction item to an income account, you will need to transfer it from your staff repayment account to an income account by journal entry. Debit staff repayment and credit the income account. You could do this proportionally with each payslip.