Hi, regarding payslip contributions, in our country the payslip normally deducts contributions before arriving at the net pay. Is there any way to work around this?

Hi @neobks91,

That means that it’s not really a Contribution, but rather a Deduction that’s being called a contribution for one reason or another.

A contribution is when the employer pays – on behalf of its employee – an amount to an external party. This amount by definition is not deductible.

If it is deductible like your case, you should create a Payslip Deduction Item.

Hi, yes, the employer pays on behalf of the employee. In Malaysia, this is called EPF(KWSP) , SOCSO, and EIS. However, these fall under liabilities and payslip deductions doesn’t show this.

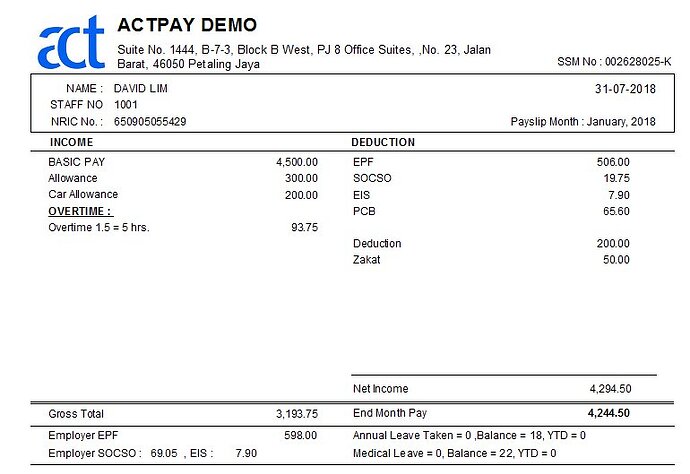

Below are some examples

@neobks91, there seems to be a confusion here, the net amount in the payslip should equal the amount transferred to the employee account for this month.

But I think I understand your situation more clearly now.

You see your EPF scheme is a shared benefit scheme where both the employer and the employee pay towards this benefit plan:

- The part payable by the employer (Employer EPF) goes to →

Payslip Contribution Item - The part deductible from the employee (EPF) goes to →

Payslip Deduction Item

Note that in the picture you provided there are two of each of the following, some with different amounts:

- EPF & Employer EPF

- SOCSO & Employer SOCSO

- EIS → I assume that this plan is 100% deductible from Employee, based on the picture above.

All of these have two components:

-

A component to calculate how much is to be paid by the Employer to a 3rd Pary → This is a

Payslip Contribution Item, that is not part of your net pay. Note that all the contribution amounts (598.00, 69.05 & 7.90) are listed after the “End Month Pay” total. -

Another component to account for the amount to be paid by the Employee through salary deduction → This is a related but separate

Payslip Deduction Itemwhich will be deducted to arrive at your “End Month Pay”. Just to confirm this, note the column heading above EPF, SOCSO, EIS, PCB, Deduction & Zakat; the column heading says “Deduction”.

I hope I haven’t overcomplicate thing with too much detail. So I will try to summarize what need to be done in practice.

You need to define the following Payslip Deduction Items:

- EPF

- SOCSO

- EIS

- PCB

- Deduction

- Zakat

On top of that, you need to define the following Payslip Contribution Items:

- Employer EPF

- Employer SOCSO

- Employer EIS

Now I understand. Sorry, my bad, thanks for clarifying!