Hi @Mabaega

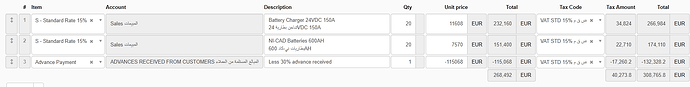

we are trying to submit 1 invoice where it required adjustment of advance payment

{

“requestUri”: “https://gw-fatoora.zatca.gov.sa/e-invoicing/developer-portal/compliance/invoices”,

“requestType”: “Invoice Compliant Check”,

“statusCode”: “400-BadRequest”,

“clearanceStatus”: “NOT_CLEARED”,

“validationResults”: {

“status”: “ERROR”,

“infoMessages”: [

{

“status”: “PASS”,

“type”: “INFO”,

“code”: “XSD_ZATCA_VALID”,

“category”: “XSD validation”,

“Message”: “Complied with UBL 2.1 standards in line with ZATCA specifications”

}

],

“warningMessages”: ,

“errorMessages”: [

{

“status”: “ERROR”,

“type”: “ERROR”,

“code”: “BR-KSA-F-04”,

“category”: “KSA”,

“Message”: “[BR-KSA-F-04]-All the document amounts and quantities must be positive, unless specified otherwise.”

}

]

}

}

I would like to check if you come across any solution to overcome this issue

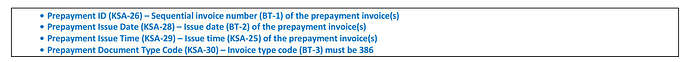

please check this link and let me know if you could improve it or we should follow same practice issue credit note to reduce subject advance payment

looking forward to receive your advise