Money deposited in your bank account should be recorded under Statement balance column.

When you click on the amount under Statement balance column, you can click Receive money button to record new transaction.

Every recorded transaction must be properly categorized. For example, if you have received 1,200 from customer for sales, you would record it like this:

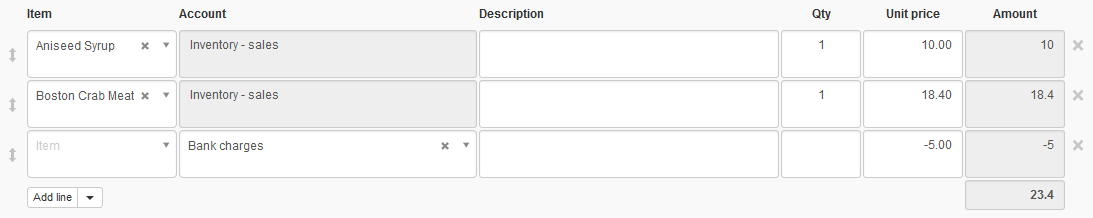

If you have received from customer 1,250 but bank has charged 50 fee, you need to split the transaction using Add line button and enter both amounts making 50 negative so the net amount deposited into bank account comes to 1,200.

You are not restricted to use only simple income accounts to categorize your bank receipts. If money in the bank account has been deposited by business owner set up under Capital Accounts tab, you can select their account too.

If money has been received from a customer set up under Customers tab, select Customer credits account. This will allocate the money received automatically against their outstanding sales invoices.

Or allocate received money against specific sales invoice.

Even inventory items can be directly sold using this method.

As you can see, it’s all about specifying the correct account or accounts to categorize all money received.