At the outset, let me say I am considering moving this topic into the bugs category. But I would very much like to get @tony’s opinion first.

@GrahamvdR, I need to apologize to you. I was traveling and at the time and did not see your post #5, with its more complete explanation of why the write-off might be taxable. In actuality, it would not be the write-off that is being taxed. It would be use of the goods by your business. I interpreted your post #1 (item #2) as referring to writing off to a business expense account such as warehouse spoilage. But I understand now that the situation you are discussing covers converting inventory from potential future sales to current usage.

On that basis, the transaction could apparently be taxable under Zimbabwe’s laws on the output side, just as if you had sold the item to someone else, because there is no other end user to pay the final stage of VAT. If that is true, contrary to what I wrote in post #4, there could be a legitimate reason to select a tax code for the write-off. Again, I am sorry I never addressed that portion of your question because of my initial misunderstanding and missing your further explanation.

Yet that interpretation would be very unusual. The more customary approach under VAT schemes would be to consider the input tax you paid to your supplier as the final link in the taxation chain. In other words, to consider that instead of buying for inventory, with the expectation of onward selling to someone else, you purchased for your own end use. In VAT vernacular, you have added no additional value. So there is no additional VAT to collect or remit. I believe you should discuss this again with your accountant. The basic circumstances are simple: you paid VAT when you purchased the item, and you are the end user. Why should any further tax be imposed?

Nevertheless, if your conversion to end-use is, indeed, taxable, here is what I believe is or should be happening:

- A write-off would be the preferred method in Manager for recording what you are doing.

- Output VAT on write-offs is correctly being applied to the tax liability account, based on the current average cost of the inventory item.

- The resulting tax on sales should show up on the Tax Audit, Tax Summary, Tax Reconciliation, and Tax Transactions reports.

- A drill-down on the tax liability account should show the appropriate tax code as applying to the write-off transaction, along with the resulting credit to the tax liability account.

- The cost of the inventory item written off should be added to the appropriate expense account, but not the tax. This would be similar to the cost of items sold to customers being added to the Inventory - cost account, but not the tax assessed to the customer.

-

Inventory on hand should be reduced by the average cost (without tax) of the inventory item written off. The transaction should show as having had the appropriate tax code applied. This part is now happening correctly.

As to what I believe is not happening correctly, assuming the write-off is really taxable:

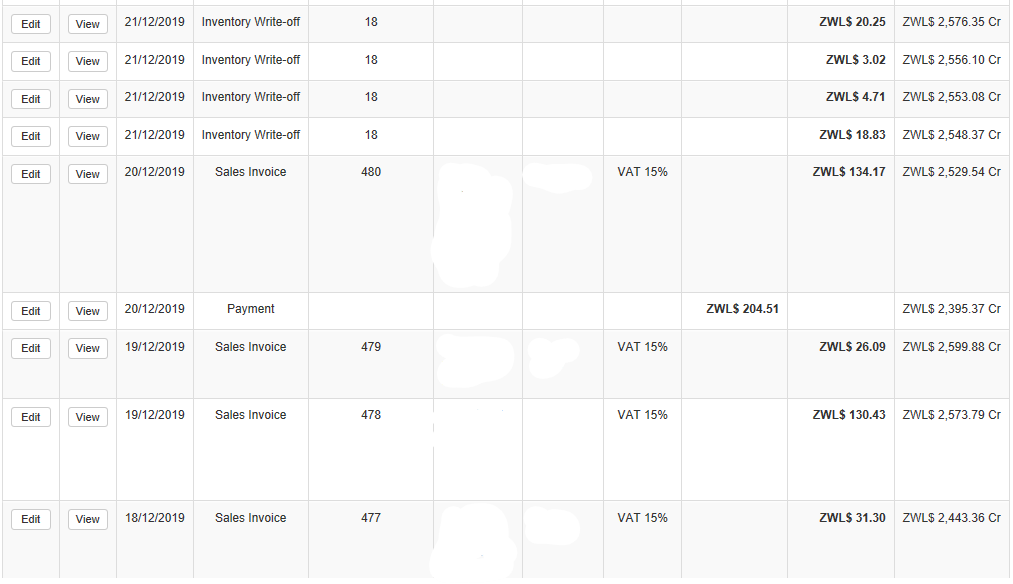

- The tax on the imputed sale from the write-off is not being picked correctly by the Tax Audit report. Instead, the transaction shows up in the

No tax column.

- A drill-down on the tax liability account shows no tax code as applying, although the credit for the tax is listed. This seems to correspond to the no-tax situation in the previous bullet.

- Tax from the write-off does not show up at all on the Tax Summary. However, the write-off transaction is included in the sales figure.

- Tax from the write-off does not show up on the Tax Transactions report. The equivalent sale is, however, also included on this report.

- Tax from the write-off is being included, along with average cost of the inventory written off, in the expense account to which the write-off is posted.

Turning to your use of journal entries, I see no reason you cannot continue doing that. After all, write-ons must currently be entered with journal entries. There is no conceptual difference between a write-off and a journal entry. So for now, do what gives the correct result.

The thing that is puzzling me in all this is balancing the debits and credits in the transaction if the conversion is truly taxable. For ease of illustration, consider an inventory item with an average cost of 100 and a 10% tax rate. A normal, non-taxable write-off would be equivalent to:

Inventory on hand 100 Cr

Inventory write-offs 100 Dr

Make the transaction taxable, and you have:

Inventory on hand 100 Cr

Tax liability 10 Cr

Inventory write-offs 100 Dr

Where do you allocate the remaining 10 debit? Right now, Manager is putting it into the Inventory write-offs account:

Inventory on hand 100 Cr

Tax liability 10 Cr

Inventory write-offs 110 Dr

So the books balance, but you are not showing the tax in several of the reports. And the allocation of both cost and tax to Inventory write-offs seems wrong, because you already claimed the input VAT when you purchased the item. So the tax is not a current expense. It was already debited to the tax liability account to offset collected VAT when the item was purchased.

All this highlights the problems with considering the conversion a taxable event.